The world of digital assets is expanding at a breathtaking pace, bringing with it a new vocabulary that can often seem confusing and interchangeable. Among the most frequently conflated terms are “cryptocurrency” and “token.” While both are fundamental building blocks of the blockchain revolution and are often traded on the same exchanges, they represent distinct concepts with different creation methods, purposes, and underlying technologies. For anyone looking to navigate the crypto space—whether as an investor, a developer, or simply a curious observer—understanding this distinction is not just a matter of semantics; it is crucial for grasping the value, function, and potential of any given digital asset.

At a glance, it’s easy to see why the terms are used interchangeably. Both are digital, both use cryptography for security, and both run on a blockchain. However, the similarities largely end there. The core difference lies in their relationship to the blockchain itself. A cryptocurrency is the native asset of its own independent blockchain, the foundational layer of a digital economy. A token, on the other hand, is built upon an existing blockchain, leveraging its infrastructure to serve a specific purpose, from representing a physical asset to granting access to a decentralized application.

Think of it like this: a cryptocurrency is the national currency of a country (like the U.S. Dollar), which is native to that country’s economic system. Tokens are more like the various assets and instruments that can exist within that country—things like company stocks, concert tickets, loyalty points, or property deeds. They all have value and can be exchanged, but they operate within the rules and infrastructure of the established national economy and often use the national currency for transactions.

This article will provide an exhaustive exploration of this critical distinction. We will delve deep into the definitions, characteristics, and technical underpinnings of both cryptocurrencies and tokens. We will journey through the vast universe of token types, from the utility tokens that power decentralized applications to the unique digital collectibles known as NFTs. We will examine how they are created, what gives them value, and how they relate to one another in a symbiotic digital ecosystem. By the end, you will have a clear and comprehensive framework for understanding these fundamental components of the new digital economy, empowering you to analyze projects and make more informed decisions in the ever-evolving world of crypto.

What is a Cryptocurrency? The Bedrock of the Digital Economy

Before we can fully appreciate what a token is, we must first have a solid understanding of the foundation upon which the entire digital asset ecosystem is built: the cryptocurrency. A cryptocurrency, often referred to as a “coin,” is a digital or virtual currency that uses cryptography for security and operates on its own independent, decentralized network called a blockchain. It is the native asset of that blockchain, meaning it is an integral part of the protocol itself.

The Defining Characteristics of a Cryptocurrency

To be classified as a cryptocurrency, a digital asset must possess several key characteristics that distinguish it from both traditional fiat currencies and other forms of digital assets like tokens:

- Native to its Own Blockchain: This is the most critical distinction. A cryptocurrency is the primary, foundational asset of a specific blockchain. Bitcoin (BTC) runs on the Bitcoin blockchain, Ether (ETH) runs on the Ethereum blockchain, and Solana (SOL) runs on the Solana blockchain. You cannot have one without the other.

- Decentralized Control: True cryptocurrencies are not issued or controlled by any single entity like a central bank or government. Instead, their issuance and the validation of transactions are managed by a distributed network of computers (nodes) through a consensus mechanism, such as Proof-of-Work (PoW) or Proof-of-Stake (PoS).

- Primary Economic Function: The primary purpose of a cryptocurrency is to function as a form of digital money. This can manifest in several ways:

- Medium of Exchange: It can be used to send and receive value directly between peers without the need for a traditional financial intermediary like a bank.

- Store of Value: It can be held over time with the expectation that it will retain its purchasing power, similar to digital gold.

- Unit of Account: It provides a common measure of value within its own ecosystem.

- Incentivizing Network Security: Cryptocurrencies play a vital role in the security and maintenance of their own blockchains. In a Proof-of-Work system like Bitcoin, miners are rewarded with new coins for dedicating computational power to validate transactions and secure the network. In a Proof-of-Stake system like Ethereum, validators are rewarded with new coins for staking their existing holdings to secure the network. This intrinsic economic incentive is what keeps the network running and secure.

The Role of a Cryptocurrency within its Ecosystem

The native cryptocurrency is the economic engine of its blockchain. Its most immediate and essential function is to serve as the payment method for transaction fees, often referred to as “gas.” Every action on a blockchain, whether it’s sending money, executing a smart contract, or creating a token, requires a small payment of the native cryptocurrency to the miners or validators who process and secure the transaction. This gas fee prevents spam on the network and compensates the network participants for their work.

For example, to send a transaction on the Bitcoin network, you must pay a fee in BTC. To interact with a decentralized application on the Ethereum network, you must pay a gas fee in ETH. This fundamental utility creates a constant and inherent demand for the native cryptocurrency, as it is the only key that can unlock the functionality of its blockchain.

In essence, a cryptocurrency is the foundational layer, the digital soil from which an entire ecosystem can grow. It is the money, the security deposit, and the fuel, all rolled into one, for its own sovereign digital nation.

What is a Token? The Diverse Assets of the Digital World

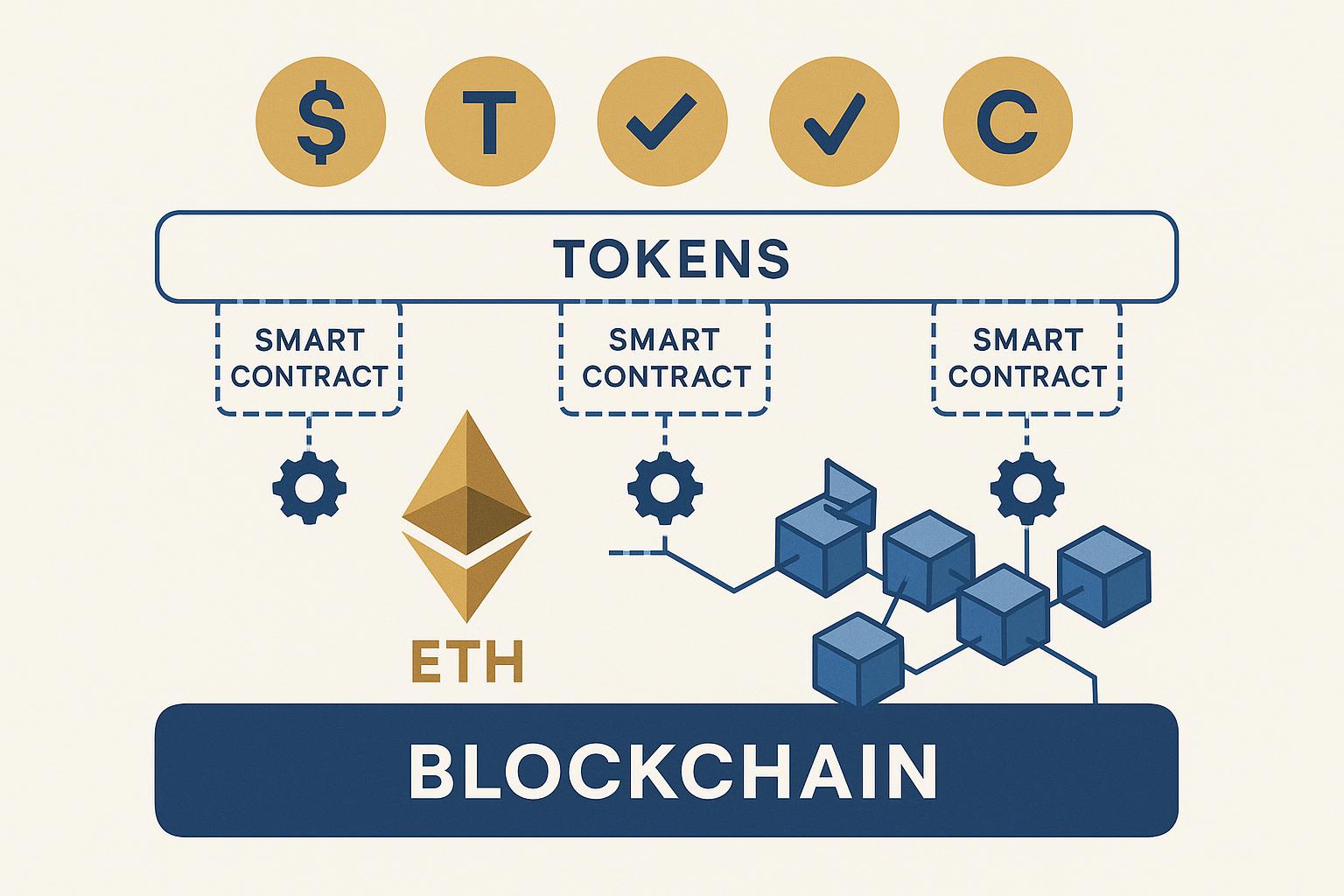

If cryptocurrencies are the native bedrock of a blockchain, then tokens are the diverse and versatile structures built on top of that foundation. A token is a type of digital asset that is created and managed on a pre-existing blockchain. Unlike cryptocurrencies, tokens do not have their own dedicated blockchain. Instead, they leverage the security, infrastructure, and consensus mechanism of a host blockchain, most commonly Ethereum, but also others like BNB Chain, Solana, and Polygon.

The Power of Smart Contracts and Token Standards

Tokens are brought to life through the magic of smart contracts. A smart contract is a self-executing piece of code that runs on a blockchain and automatically enforces a set of pre-defined rules. When a project wants to create a token, they deploy a smart contract that defines the token’s properties: its name, its symbol, its total supply, and the rules for how it can be transferred, created, or destroyed.

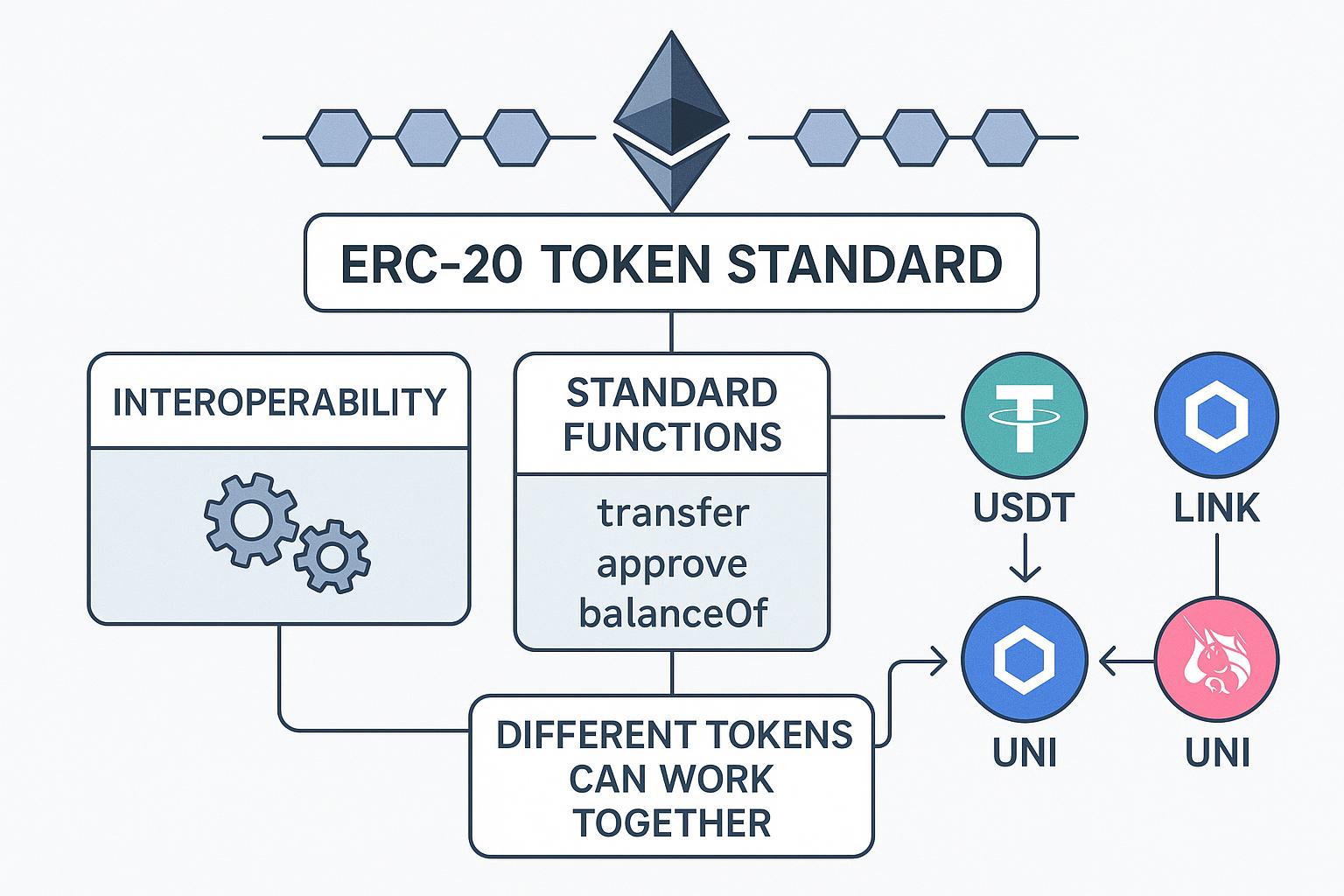

To ensure that tokens can be easily exchanged and interact with each other and with decentralized applications (dApps) like wallets and exchanges, they are typically built according to established token standards. These standards are essentially blueprints that outline a common set of functions and interfaces that a token contract must implement. The most famous and widely adopted token standard is Ethereum’s **ERC-20**.

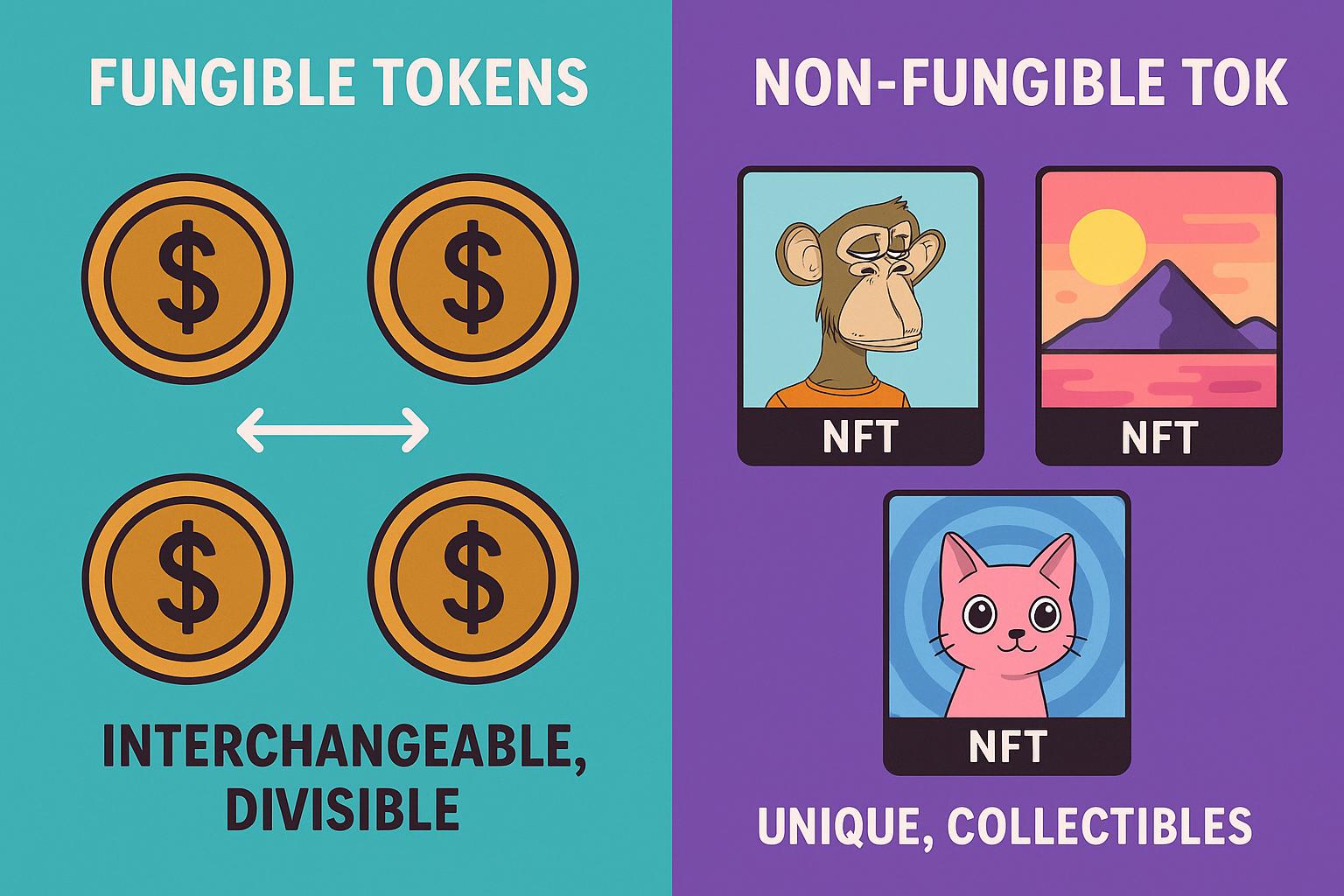

An ERC-20 token is a fungible token, meaning each unit is identical and interchangeable with any other unit, just like a dollar bill. This standard ensures that any ERC-20 token can be seamlessly integrated into the vast Ethereum ecosystem. Other blockchains have similar standards, but ERC-20 remains the most dominant. This standardization is what allows you to store hundreds of different types of tokens in a single Ethereum wallet and trade them on a decentralized exchange like Uniswap.

The Key Difference Summarized

The core distinction can be boiled down to a simple table:

| Feature | Cryptocurrency (Coin) | Token |

|---|---|---|

| Blockchain | Has its own native, independent blockchain. | Built on top of a pre-existing blockchain. |

| Creation | Created through the blockchain’s core protocol. | Created by deploying a smart contract. |

| Primary Role | Acts as money and fuel for its own network. | Represents a specific asset or utility. |

| Transaction Fees | Paid in the native cryptocurrency (e.g., BTC, ETH). | Paid in the native cryptocurrency of the host blockchain (e.g., ETH for ERC-20 tokens). |

| Examples | Bitcoin (BTC), Ether (ETH), Cardano (ADA) | Chainlink (LINK), Uniswap (UNI), Tether (USDT) |

When you send an ERC-20 token like UNI from one wallet to another, you are not interacting with a Uniswap blockchain. You are executing a function within the UNI smart contract on the Ethereum blockchain. And to pay for that transaction, you must use ETH, the native cryptocurrency of the host network. This highlights the symbiotic relationship between tokens and their underlying cryptocurrencies.

A Universe of Possibilities: The Many Types of Tokens

The true power and versatility of the token concept become apparent when we explore the vast and growing universe of token types. Because tokens are essentially programmable assets, they can be designed to represent almost anything and to serve a virtually limitless range of functions. This flexibility has led to an explosion of innovation, with new types of tokens emerging to solve different problems and create new economic models. Let’s explore the most prominent categories.

1. Utility Tokens: The Keys to a Decentralized World

Utility tokens are perhaps the most common and straightforward type of token. They are designed to provide access to a product or service within a specific decentralized application or ecosystem. They are not primarily designed as investments; rather, their value is derived from the utility they provide. Think of them as digital keys or access passes.

A classic example is **Chainlink (LINK)**. The Chainlink network is a decentralized oracle service that provides real-world data to smart contracts. To request data from the Chainlink network, a user must pay the oracle providers in LINK tokens. The more dApps that rely on Chainlink for data, the greater the demand for LINK tokens to pay for those services. Other examples include **Filecoin (FIL)**, used to pay for decentralized data storage, and the original concept of **BNB**, used to get discounts on trading fees on the Binance exchange.

2. Security Tokens: The Future of Finance

Security tokens are a digital representation of ownership in a traditional financial asset. They are the blockchain equivalent of stocks, bonds, or real estate deeds. Because they represent a stake in an external, tradable asset, security tokens are subject to federal securities regulations. This means they must be issued and traded in compliance with the law, which often involves processes like Know Your Customer (KYC) and Anti-Money Laundering (AML) checks.

The promise of security tokens is immense. They have the potential to democratize access to investments that have traditionally been illiquid and exclusive, such as commercial real estate or fine art. By tokenizing these assets, they can be fractionalized, allowing smaller investors to buy a piece of a skyscraper or a Picasso. They also enable 24/7 trading on global markets with near-instant settlement, dramatically increasing liquidity and efficiency. While the regulatory landscape is still evolving, many believe that the tokenization of real-world assets will be a multi-trillion dollar industry.

3. Governance Tokens: Power to the People

In the world of Decentralized Autonomous Organizations (DAOs) and DeFi protocols, governance tokens give holders the power to influence the future of a project. They are a form of voting rights. The more governance tokens a user holds, the more weight their vote carries in proposals regarding the protocol’s development, such as changing a fee structure, upgrading the code, or allocating funds from the community treasury.

**Uniswap (UNI)** and **Compound (COMP)** are prime examples. Holders of these tokens can vote on key decisions that shape the future of these leading DeFi protocols. This model of decentralized governance is a radical departure from the top-down corporate structures of the traditional world. It aims to create more democratic, transparent, and community-driven organizations where the users who have a stake in the protocol also have a say in its direction.

4. Stablecoins: The Best of Both Worlds

Stablecoins are a type of token designed to maintain a stable value by being pegged to a less volatile asset, most commonly the U.S. Dollar. They are the essential bridge between the volatile world of crypto and the stability of traditional finance. They allow traders and users to hold a digital asset without being exposed to the wild price swings of cryptocurrencies like Bitcoin or Ether.

There are several types of stablecoins:

- Fiat-Collateralized: These are the most common type. For every token in circulation, there is a corresponding dollar (or other fiat currency) held in a bank account. **Tether (USDT)** and **USD Coin (USDC)** are the largest examples.

- Crypto-Collateralized: These are backed by a basket of other cryptocurrencies. To maintain stability, they are typically over-collateralized, meaning the value of the crypto held in reserve is greater than the value of the stablecoins issued. **DAI** is the most well-known example.

- Algorithmic: These use complex algorithms and smart contracts to manage the token supply, automatically increasing or decreasing it to keep the price stable. This is the most experimental and riskiest type of stablecoin.

Stablecoins are the lifeblood of the DeFi ecosystem, used for lending, borrowing, and as a primary trading pair on decentralized exchanges.

5. Non-Fungible Tokens (NFTs): The Revolution of Digital Ownership

This is where the concept of a token truly breaks away from the idea of money. While all the tokens we’ve discussed so far are fungible (interchangeable), Non-Fungible Tokens (NFTs) are, by definition, unique. Each NFT is a one-of-a-kind digital asset with a unique identifier that distinguishes it from every other token. They are created using a different token standard, most commonly **ERC-721**.

Because they are unique, NFTs are the perfect tool for representing ownership of a specific digital or physical item. This has led to a cultural explosion, with NFTs being used for:

- Digital Art: Artists can now create and sell verifiable, provably scarce digital artwork.

- Collectibles: Projects like CryptoPunks and Bored Ape Yacht Club have become status symbols in the digital world.

- Gaming: In-game items like swords, skins, or plots of land can be owned as NFTs, allowing players to truly own and trade their in-game assets.

- Domain Names: Services like the Ethereum Name Service (ENS) use NFTs to represent unique blockchain domain names.

- Ticketing and Memberships: A unique ticket to an event or a membership pass to a club can be issued as an NFT.

NFTs have fundamentally changed our understanding of ownership and value in the digital age, creating entirely new markets and possibilities.

The Interplay: How Coins and Tokens Create a Symbiotic Ecosystem

It is crucial to understand that cryptocurrencies and tokens are not in competition with each other. Rather, they exist in a deeply symbiotic relationship. The most vibrant and valuable token ecosystems are built on the most secure and widely adopted blockchains. The success of the thousands of ERC-20 tokens and NFTs on Ethereum is a direct contributor to the value and utility of Ether (ETH), the native cryptocurrency.

Every time a token is transferred, traded on a DEX, or used in a DeFi protocol, a transaction fee must be paid in the native coin of the host blockchain. The explosion of activity in the token ecosystem on Ethereum has led to a massive and sustained demand for ETH to pay for gas fees. This, in turn, incentivizes more miners and validators to secure the Ethereum network, making it an even more attractive platform for new token projects to build on. It is a powerful and self-reinforcing feedback loop.

A thriving token ecosystem gives a blockchain a powerful network effect. It creates a sticky and vibrant economy that draws in users, developers, and capital. A blockchain with no tokens is like a country with no businesses, no assets, and no culture—it may have a currency, but there is little to do with it. Conversely, a token without a secure and reliable blockchain to run on is like a business with no legal system or infrastructure to support it—it is a fragile and risky proposition.

Investment Implications: Analyzing Coins vs. Tokens

From an investment perspective, the distinction between coins and tokens is critical. The investment thesis for each is fundamentally different, and they carry different risk-reward profiles.

Investing in Cryptocurrencies (Coins)

When you invest in a native cryptocurrency like BTC or ETH, you are making a bet on the long-term success and adoption of the entire blockchain network. The value of a coin is driven by factors such as:

- Network Security and Decentralization: A more secure and decentralized network is more valuable.

- Adoption and Network Effects: The more users, developers, and dApps a blockchain has, the more valuable its native coin becomes.

- Demand for Block Space: The value of the native coin is directly tied to the demand for its block space. A high volume of transactions and a thriving token ecosystem lead to higher gas fees and greater demand for the native coin.

- Monetary Policy: The coin’s issuance schedule (e.g., Bitcoin’s halving) and whether it is inflationary or deflationary play a major role in its long-term value.

Investing in a major cryptocurrency is often seen as a more conservative (by crypto standards) bet on the growth of the underlying infrastructure of the Web3 world.

Investing in Tokens

When you invest in a token, you are making a much more specific bet on the success of a single project, application, or asset. The value of a token is driven by factors that are specific to that project:

- Project-Specific Utility: For a utility token, its value is tied to the demand for the product or service it provides access to.

- Governance Power: For a governance token, its value is derived from the influence it gives holders over a valuable protocol.

- Underlying Asset Value: For a security token or an NFT, its value is directly linked to the value of the asset it represents.

- Team and Execution: The quality and track record of the team behind the project are paramount.

- Tokenomics: The token’s supply, distribution, and incentive mechanisms are crucial to its long-term value.

Token investments are generally higher up the risk curve. They offer the potential for explosive, venture-capital-style returns, but they also carry a much higher risk of failure. For every successful token project, there are hundreds that fail to gain traction and fade into obscurity.

The Future is Tokenized: Emerging Trends and Possibilities

The innovation in the token space is far from over. We are just beginning to scratch the surface of what is possible with programmable, blockchain-based assets. Several exciting trends are emerging that promise to further expand the role of tokens in our digital and physical lives.

The Rise of Social Tokens

Social tokens, also known as creator coins or community tokens, are a new type of token that allows creators, artists, and online communities to create their own branded digital currencies. These tokens can be used to grant access to exclusive content, private chat groups, early access to merchandise, or other special perks. They create a direct economic link between a creator and their fans, allowing the community to share in the success of the creator they support. This has the potential to revolutionize the creator economy, providing new monetization models beyond traditional advertising and subscriptions.

Tokenization of Real-World Assets (RWA)

While security tokens have laid the groundwork, the broader trend of tokenizing real-world assets is gaining significant momentum. This involves creating a digital representation of a physical asset, such as real estate, art, or even a classic car, on a blockchain. This process can unlock immense value by making illiquid assets easily tradable and fractionalizable. Imagine being able to buy and sell a small fraction of a commercial building in Tokyo as easily as you can trade a stock. This could democratize access to a whole new range of investment opportunities and create a more efficient and global marketplace for all types of assets.

The Intersection of Gaming and Finance (GameFi)

The gaming industry is a natural fit for tokenization. By representing in-game items like characters, weapons, and land as NFTs, games can create a true player-owned economy. Players can earn valuable tokens and NFTs through gameplay (a model known as “play-to-earn”), and then trade them on open marketplaces. This blurs the line between gaming and finance, creating a new category known as GameFi. This has the potential to transform gaming from a simple leisure activity into a viable economic pursuit for millions of people around the world.

Conclusion: A New Financial Paradigm

The distinction between cryptocurrencies and tokens is far more than a technicality; it is the key to understanding the architecture of the new digital economy. Cryptocurrencies are the sovereign foundations, the decentralized bedrock that provides security, immutability, and a native medium of exchange. They are the digital nations of the 21st century.

Tokens, in all their diverse and wonderful forms, are the assets, products, and services that populate these digital nations. They are the engines of commerce, culture, and governance that make these ecosystems vibrant and valuable. From the utility of accessing a service, to the power of governing a protocol, to the pride of owning a unique piece of digital art, tokens allow us to represent and exchange value in ways that were never before possible.

Together, they create a powerful, symbiotic system. The success of a blockchain depends on the richness of its token ecosystem, and the success of a token depends on the security and reliability of its host blockchain. As we move further into a tokenized future, the lines may continue to blur, and new and hybrid forms of digital assets will undoubtedly emerge. But the fundamental relationship between the foundational coin and the assets built upon it will remain the cornerstone of the decentralized world. Understanding this relationship is the first and most important step towards navigating this exciting and transformative new financial paradigm.

A Journey Through Time: The Evolution of Tokens

The concept of a token did not emerge overnight. It has been a gradual evolution, built on years of experimentation and innovation in the blockchain space. Understanding this history provides valuable context for why tokens have become so central to the modern crypto landscape.

The Pre-Ethereum Era: Colored Coins

Long before Ethereum and its smart contract capabilities, the earliest experiments with tokenization took place on the Bitcoin blockchain itself. The concept of “Colored Coins” emerged around 2012. This was a method for associating real-world assets with specific, small amounts of bitcoin. By “coloring” a small fraction of a bitcoin, it could be made to represent something else, like a company share, a property deed, or a concert ticket. While revolutionary in concept, the Bitcoin blockchain’s limited scripting capabilities made this process cumbersome and inflexible. It was a hint of what was possible, but the technology was not yet ready.

The Ethereum Revolution and the ICO Boom

The launch of Ethereum in 2015 was the watershed moment for tokens. Its Turing-complete programming language, Solidity, and the introduction of smart contracts made the creation of custom digital assets incredibly easy. The ERC-20 standard, proposed in 2015 and finalized in 2017, was the spark that lit the fire. It created a common, interoperable blueprint that anyone could use to launch a new token. This led to the Initial Coin Offering (ICO) boom of 2017 and 2018.

During the ICO craze, thousands of projects raised billions of dollars by selling newly created tokens to the public. While this period was marked by rampant speculation and many fraudulent projects, it was also a period of intense innovation. It demonstrated the power of tokens as a fundraising mechanism and led to the creation of many of the foundational projects that underpin the DeFi and Web3 ecosystems today.

The Rise of DeFi and the Utility of Governance

Following the ICO bust, the market matured. The focus shifted from pure speculation to building real, sustainable projects with clear utility. This led to the rise of Decentralized Finance (DeFi) in 2020, often dubbed “DeFi Summer.” Projects like Compound and Uniswap introduced the concept of governance tokens, which gave users a say in the protocol’s future. This was a powerful new model that aligned the incentives of the developers and the users, creating strong and engaged communities.

The NFT Explosion and the Mainstream Breakthrough

While NFTs had existed since 2017 (with projects like CryptoPunks), it was in 2021 that they exploded into the mainstream consciousness. The sale of Beeple’s “Everydays: The First 5000 Days” for $69 million at Christie’s auction house was a landmark event that brought NFTs to the attention of the world. This demonstrated that tokens could represent not just financial value, but also cultural value. The NFT boom has onboarded millions of new users into the crypto space and has expanded the concept of digital ownership into art, music, gaming, and beyond.

A Technical Deep Dive: How Are Tokens Actually Created?

To truly appreciate the difference between a coin and a token, it helps to understand the technical process of token creation. While creating a new cryptocurrency requires building an entire blockchain from scratch—a monumental undertaking—creating a token is a relatively straightforward process for a developer familiar with smart contracts.

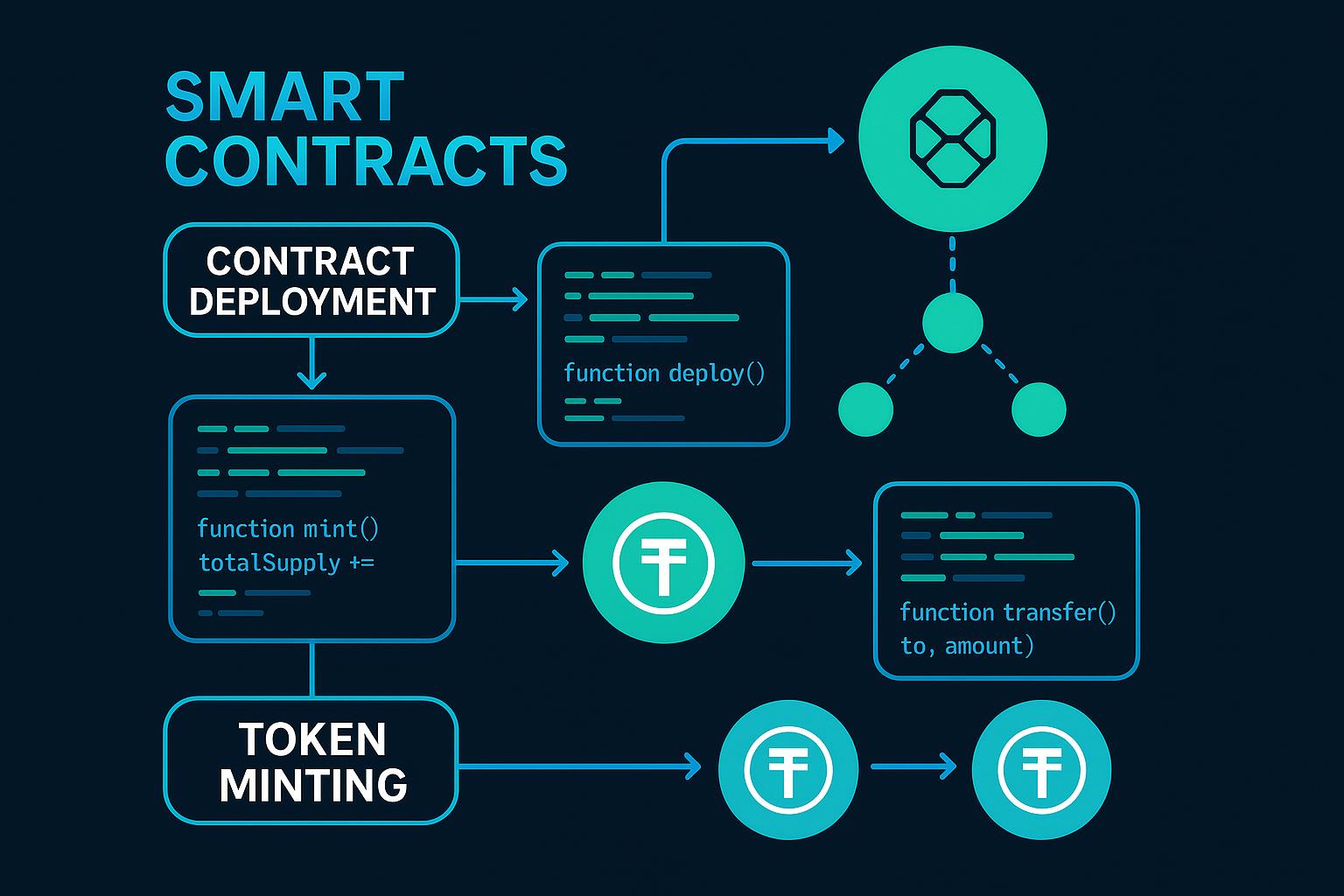

The Smart Contract: The Token’s DNA

The heart of any token is its smart contract. This is a piece of code deployed to a blockchain like Ethereum. The contract is immutable, meaning once it’s deployed, it cannot be changed. This code defines all the essential properties and functions of the token. For an ERC-20 token, the contract must include a standard set of functions, including:

totalSupply(): Returns the total number of tokens in circulation.balanceOf(address owner): Returns the token balance of a specific wallet address.transfer(address to, uint256 value): Allows a user to send tokens to another address.approve(address spender, uint256 value): Allows a user to authorize another address (often a smart contract like a decentralized exchange) to spend a certain number of their tokens.transferFrom(address from, address to, uint256 value): Used by the authorized spender to execute the transfer.

The smart contract also contains a mapping, which is essentially a ledger that keeps track of who owns how many tokens. It’s a simple list of wallet addresses and their corresponding balances. When a transfer happens, the transfer function simply subtracts the amount from the sender’s balance and adds it to the receiver’s balance in this ledger. The entire process is automated and enforced by the code of the smart contract.

The Deployment Process

To launch a new token, a developer simply needs to:

- Write the smart contract code according to the desired token standard (e.g., ERC-20).

- Compile the code into bytecode that the Ethereum Virtual Machine (EVM) can understand.

- Deploy the compiled code to the Ethereum blockchain by sending a special transaction. This requires paying a gas fee in ETH.

Once the transaction is confirmed, the smart contract is live on the blockchain, and the new token officially exists. The developer can then interact with the contract to mint the initial supply of tokens and distribute them according to their project’s plan.

The Regulatory Landscape: A Complex and Evolving Picture

The legal and regulatory status of digital assets is one of the most critical and complex issues facing the industry. Regulators around the world are still grappling with how to classify and regulate these new technologies. The distinction between coins and tokens is at the heart of this debate.

The Howey Test and the Question of Securities

In the United States, the primary framework for determining whether an asset is a security is the Howey Test, which stems from a 1946 Supreme Court case. According to the Howey Test, an asset is considered a security if it involves:

- An investment of money

- In a common enterprise

- With an expectation of profit

- To be derived from the efforts of others

Many tokens, especially those sold in ICOs to fund the development of a project, fit this definition quite well. This is why the Securities and Exchange Commission (SEC) has taken the position that many tokens are unregistered securities. This has significant legal implications for the projects that issue them and the exchanges that list them.

Are Cryptocurrencies Commodities?

On the other hand, cryptocurrencies like Bitcoin are often viewed by regulators as commodities, similar to gold or oil. This is because they are more decentralized and are not issued by a central entity that is responsible for the project’s success. The Commodity Futures Trading Commission (CFTC) has asserted its jurisdiction over cryptocurrency derivatives. The status of Ether is more ambiguous, with some regulators viewing it as a commodity and others suggesting it may have been a security at its inception.

The Global Picture

The regulatory approach varies significantly from country to country. Some nations, like El Salvador, have embraced Bitcoin as legal tender. Others, like China, have banned cryptocurrencies outright. Many countries are still in the process of developing comprehensive regulatory frameworks. This regulatory uncertainty remains one of the biggest challenges for the long-term growth and adoption of digital assets. A clear and consistent regulatory framework is needed to protect consumers and foster innovation.

Ultimately, the journey into the world of digital assets begins with understanding its fundamental components. The distinction between a native cryptocurrency that powers a blockchain and a token that is built upon it is the essential first principle. Grasping this concept unlocks a deeper appreciation for the intricate and interconnected economy of Web3. It allows one to see beyond the speculative noise and recognize the profound technological innovation at play: a new, programmable, and global financial infrastructure being built from the ground up, one block and one token at a time. The future is not just about new forms of money; it’s about new ways of representing and exchanging all forms of value, and tokens are the versatile instruments that will make this future a reality.