In a world saturated with targeted ads, one-click purchasing, and the relentless pressure to keep up with the latest trends, the path to financial ruin is often paved with small, seemingly insignificant daily choices. We tell ourselves it’s just a coffee, a new gadget on sale, or a subscription we might use someday. But these minor leaks, when left unchecked, can sink even the most promising financial ship. The journey to financial freedom isn’t just about earning more money; it’s about mastering the art of keeping and growing it. This begins with a ruthless examination of our habits—the silent, automatic behaviors that dictate where our hard-earned money goes every single day.

Many people drift through their financial lives on autopilot, unaware of the destructive patterns that are quietly sabotaging their future. They work hard, pay their bills, and yet, at the end of the month, they are left wondering where all their money went. They dream of buying a home, traveling the world, or retiring comfortably, but these goals remain perpetually out of reach, shrouded in a fog of financial anxiety. The culprit is often not a single catastrophic event, but a series of seemingly harmless habits that, like a thousand tiny cuts, slowly bleed their financial potential dry. These habits are insidious because they are normalized by society and fueled by powerful psychological triggers.

This article is a wake-up call. It is a deep dive into the seven most destructive financial habits that are keeping you from living the life you want. We will not only identify these silent wealth killers but also dissect the psychological traps that make them so powerful. More importantly, we will provide a clear, actionable blueprint for breaking free from these cycles. This is not about deprivation or living a life devoid of joy. It is about conscious, intentional living. It’s about reclaiming control over your money so that you can direct it towards what truly matters to you. It’s time to stop being a passive consumer in your own life and become the active architect of your financial destiny. Let’s begin the journey of identifying and eliminating the habits that are destroying your financial life, one conscious decision at a time.

Habit 1: The Impulse Buying Trap: The High Cost of Instant Gratification

Impulse buying is perhaps the most common and seductive of all destructive financial habits. It’s the unplanned purchase, the item you didn’t know you needed until you saw it. It’s the thrill of the checkout click, the dopamine hit of acquiring something new. It can be as small as a candy bar at the grocery store checkout or as large as a luxury car you saw in a showroom. While an occasional spontaneous treat is harmless, a consistent pattern of impulse buying is a direct assault on your financial future. It represents a fundamental disconnect between your long-term goals and your short-term actions.

The Psychology Behind the Impulse

To conquer this habit, we must first understand the powerful psychological forces at play. Impulse purchases are rarely about the item itself; they are about the feeling the purchase provides. Retailers and marketers are masters of exploiting these emotional triggers:

- Emotional Regulation: Many people use shopping as a way to cope with negative emotions like stress, boredom, sadness, or anxiety. This is often referred to as “retail therapy.” The temporary high of a new purchase provides a fleeting distraction from underlying emotional issues. You’re not just buying a new pair of shoes; you’re buying a moment of happiness or a temporary escape from reality.

- The Fear of Missing Out (FOMO): Limited-time offers, flash sales, and “only 3 left in stock!” notifications are all designed to create a sense of urgency. They trigger our primal fear of missing out on a good deal or a desirable item, pushing us to buy now and think later. This tactic bypasses our rational brain and appeals directly to our scarcity mindset.

- Social Validation and Status: In a world dominated by social media, we are constantly bombarded with images of what others have. This can create a powerful desire to keep up, to project an image of success and status through our possessions. An impulse purchase of a trendy gadget or a designer handbag can be a subconscious attempt to gain social validation and feel like we belong.

- The Pleasure Principle: Our brains are wired to seek pleasure and avoid pain. The act of buying something new releases dopamine, a neurotransmitter associated with pleasure and reward. This creates a powerful feedback loop: you feel good when you buy something, so you are more likely to do it again in the future, creating a cycle that can be as addictive as any other compulsive behavior.

The Long-Term Financial Destruction

The immediate cost of an impulse purchase is obvious. The true damage, however, lies in the long-term consequences and the opportunity cost. That BRL 20 spent on a fancy coffee every workday doesn’t seem like much, but it adds up to over BRL 5,000 a year. That’s BRL 5,000 that could have been invested, used to pay down debt, or saved for a down payment on a house. When you factor in the power of compound interest, the true cost of that daily coffee over 30 years could be hundreds of thousands of reais.

Consistent impulse spending leads to a host of financial problems:

– **Credit Card Debt:** Most large impulse purchases are made with credit cards. This can quickly lead to a mountain of high-interest debt that becomes incredibly difficult to pay off.

– **Budget Failure:** It is impossible to stick to a budget when you are constantly making unplanned purchases. This leads to a chronic lack of financial control and awareness.

– **Clutter and Waste:** Our homes become filled with things we don’t need or use, items that once provided a fleeting moment of pleasure but now only gather dust. This is not just a financial waste but an environmental one as well.

– **Financial Anxiety:** The initial thrill of the purchase is often followed by a wave of buyer’s remorse and anxiety. This creates a toxic cycle of spending to feel good, only to feel worse later, which can have a serious impact on mental health.

The Blueprint for Breaking the Habit

Breaking the impulse buying habit requires a conscious and strategic effort. It’s about creating friction between the impulse and the action. Here’s how to do it:

- Implement the 24-Hour Rule: This is the single most effective tactic. Whenever you feel the urge to make an unplanned purchase over a certain amount (say, BRL 100), force yourself to wait 24 hours. This cooling-off period allows the initial emotional urge to subside and your rational brain to take over. After 24 hours, you will often find that the desire has vanished or that you can clearly see that the purchase is unnecessary.

- Unsubscribe and Unfollow: You are constantly being sold to. Reduce the temptation by unsubscribing from marketing emails, unfollowing influencer accounts that promote excessive consumerism, and blocking ads on your browser. Create a digital environment that supports your financial goals, not one that sabotages them.

- **Identify Your Triggers:** Keep a journal for a few weeks and note down every time you make an impulse purchase. What were you feeling at that moment? Were you bored, stressed, or sad? Where were you? Were you scrolling on your phone or walking through a specific store? Identifying your triggers is the first step to developing healthier coping mechanisms. If you spend when you’re stressed, find a new, healthier stress-reliever, like going for a walk, listening to music, or calling a friend.

- Shop with a List and with Cash: Never go shopping, whether online or in-person, without a specific list of what you need. Commit to buying only what is on the list. Whenever possible, use cash or a debit card instead of a credit card. The physical act of handing over cash makes the purchase feel more real and can act as a natural brake on spending.

- Visualize Your Goals: Constantly remind yourself of what you are saving for. Put a picture of your dream home on your fridge or as your phone’s wallpaper. When the urge to make an impulse purchase strikes, look at that picture and ask yourself: “Will this purchase move me closer to my goal, or further away from it?” This simple act can provide the motivation needed to make the right long-term choice.

Taming the impulse buying beast is not about living a life of austerity. It is about shifting from mindless consumption to mindful spending. It’s about ensuring that your money is a tool that serves your deepest values and most important goals, not a fleeting balm for temporary emotions.

Habit 2: The No-Emergency-Fund Catastrophe: Living on the Financial Edge

If impulse buying is a slow leak in your financial boat, then having no emergency fund is like sailing in a storm with no life raft. It is a habit of omission, a failure to prepare for the inevitable twists and turns of life. Living without a financial safety net is one of the most precarious and stressful ways to exist. It means that you are always just one unexpected event—a job loss, a medical crisis, a major car repair—away from a full-blown financial catastrophe. This single habit can undo years of hard work and trap you in a cycle of debt and anxiety from which it is incredibly difficult to escape.

The Illusion of Stability

Many people, especially when they are young and healthy, operate under a dangerous illusion of stability. They assume their income is secure, their health is guaranteed, and their car will run forever. Their financial plan is based on the best-case scenario, with no room for error or misfortune. This is not optimism; it is financial negligence. Life is inherently unpredictable. The question is not *if* an emergency will happen, but *when*. An emergency fund is the buffer between a manageable inconvenience and a life-altering disaster.

Without this buffer, here’s what happens when the unexpected strikes:

– **Immediate Debt:** The most common reaction is to turn to high-interest credit cards to cover the cost. A BRL 3,000 car repair bill suddenly becomes a BRL 3,000 credit card balance, which, if not paid off quickly, can balloon with interest charges, becoming a long-term financial burden.

– **Raiding Long-Term Savings:** Some people are forced to pull money from their retirement accounts or other long-term investments. This is a catastrophic move. Not only do you face taxes and early withdrawal penalties, but you are also stealing from your future self. You lose the future growth and compounding potential of that money, a loss that is almost impossible to recover.

– **Derailing Financial Goals:** All progress towards positive financial goals, like saving for a down payment or investing, comes to a screeching halt. All available cash flow must be diverted to dealing with the immediate crisis. This can set you back years on your financial journey.

– **Extreme Stress and Desperation:** The financial strain of an emergency is immense, but the emotional toll is often worse. The stress and anxiety can impact your health, your relationships, and your job performance. It can lead to desperate, poor decisions, such as taking out predatory payday loans, which only compound the problem.

What Constitutes a True Emergency?

It’s crucial to define what an emergency fund is for. It is not a slush fund for a vacation, a new TV, or a down payment on a car. An emergency fund is strictly for unexpected, essential expenses. The three classic examples are:

1. **Loss of Income:** If you or your partner loses a job, the emergency fund gives you the breathing room to pay your bills and support your family while you search for new employment, without having to take the first desperate offer that comes along.

2. **Major Medical or Dental Expenses:** Even with insurance, a serious illness or accident can come with significant out-of-pocket costs, from deductibles and co-pays to treatments that aren’t fully covered.

3. **Urgent and Unexpected Repairs:** This includes a major car repair that you need to get to work, a leaking roof, or a broken furnace in the middle of winter.

A sale on plane tickets is not an emergency. A desire for a new phone is not an emergency. Protecting the integrity of this fund is just as important as building it.

The Blueprint for Building Your Financial Fortress

Building an emergency fund can feel intimidating, especially if you are living paycheck to paycheck. The key is to start small and be consistent. The feeling of security that comes from having even a small buffer is a powerful motivator.

- Step 1: Start with a Starter Fund. The initial goal is not to save six months of expenses. That can feel overwhelming. The first goal is to save a much more manageable amount, like BRL 1,000 or BRL 2,000. This is your “baby emergency fund.” This amount is enough to cover most small, annoying surprises, like a flat tire or a broken appliance, and prevent you from reaching for a credit card. Do whatever it takes to get to this first goal quickly: sell some things you don’t need, pick up a few extra hours at work, or cut all non-essential spending for a month.

- Step 2: Open a Separate, High-Yield Savings Account. Your emergency fund must be liquid (easily accessible), but it should not be *too* accessible. Do not keep it in your regular checking account where you might be tempted to spend it. Open a separate, high-yield savings account at an online bank. This has two benefits: you will earn a much higher interest rate than at a traditional brick-and-mortar bank, and the slight delay in transferring the money (usually 1-2 business days) provides a crucial psychological barrier against using it for non-emergencies. Label this account “EMERGENCY FUND – DO NOT TOUCH.”

- Step 3: Automate Your Savings. This is the most critical step for long-term success. Decide on a realistic amount you can save each week or each month, even if it’s just BRL 50. Set up an automatic transfer from your checking account to your emergency fund account the day after you get paid. This “pay yourself first” strategy ensures that the money is saved before you have a chance to spend it. You will be amazed at how quickly the fund grows without you even noticing the money is gone.

- Step 4: Build to 3-6 Months of Essential Expenses. Once you have your starter fund, continue the automatic transfers until you have accumulated enough to cover 3 to 6 months of your essential living expenses. This includes your rent/mortgage, utilities, food, transportation, and insurance—the bare minimum you need to survive. The exact amount depends on your risk tolerance and job stability. If you are in a very stable job with multiple sources of income, 3 months might be sufficient. If you are a freelancer, a commission-based salesperson, or in a volatile industry, you should aim for 6 months or even more.

- Step 5: Replenish Immediately. If you have to use your emergency fund, your number one financial priority becomes replenishing it. Pause your other savings goals (like retirement investing, beyond any employer match) and aggressively redirect all available cash flow to rebuilding your safety net back to its fully-funded level.

An emergency fund is the foundation of financial health. It is the bedrock upon which all other financial goals are built. It buys you peace of mind, freedom, and the ability to make decisions from a position of strength, not desperation. It is the ultimate act of financial self-care, and it is a habit that pays dividends for a lifetime.

Habit 3: The Credit Card Debt Cycle: The Modern-Day Financial Quicksand

If living without an emergency fund is like walking a tightrope without a net, then carrying a balance on high-interest credit cards is like willingly walking into financial quicksand. It is a habit that feels deceptively manageable at first. The minimum payment seems small, and the ability to buy now and “pay later” feels like a superpower. However, this convenience is a trap, a mathematical certainty that will systematically drain your wealth and hold you captive for years, or even decades. Of all the destructive financial habits, credit card debt is arguably the most aggressive and difficult to escape.

The Math That Works Against You

To understand the true evil of credit card debt, you must understand the brutal mathematics of compounding interest when it is working against you. Credit card companies charge some of the highest interest rates in the consumer finance world, often ranging from 15% to 30% or even higher. When you carry a balance, this interest is not just charged on the original amount you spent; it is charged on the interest itself. It creates a vicious, exponential cycle.

Consider a BRL 5,000 balance on a credit card with a 24% Annual Percentage Rate (APR). If you only make the minimum payment each month (typically around 2-3% of the balance), it could take you over 20 years to pay off the debt, and you would end up paying more than BRL 10,000 in interest alone. You would pay three times the original cost of the items you purchased. You are not just paying for a product; you are paying an exorbitant fee for the “privilege” of not paying for it immediately. This is not a loan; it is a wealth-transfer machine, moving money from your pocket directly to the bank’s bottom line.

The Psychological Allure of “Minimum Payments”

Credit card companies are masters of behavioral psychology. The concept of the “minimum payment” is one of their most brilliant and insidious inventions. It creates a false sense of affordability. It makes a large debt seem small and manageable. Paying only the minimum provides the psychological illusion that you are meeting your obligation, that you are being responsible. In reality, you are doing the bare minimum to stay afloat while the interest tsunami builds. It’s like trying to bail out a sinking ship with a teaspoon.

This habit is also fueled by a lack of financial education. Many people simply do not understand how credit card interest is calculated. They see the minimum payment as the “recommended” payment, not as the trap it truly is. They fail to realize that every purchase made on a card with an existing balance begins accruing interest immediately, digging the hole even deeper.

The Devastating Ripple Effects

The damage from credit card debt extends far beyond the interest payments. It creates a cascade of negative financial and emotional consequences:

– **Destroyed Credit Score:** A high credit card balance leads to a high credit utilization ratio, which is a major factor in determining your credit score. A low credit score makes it more difficult and expensive to get approved for other types of loans, such as a mortgage or a car loan. You become a high-risk borrower, and you will pay for it in the form of higher interest rates on all future borrowing.

– **Financial Stagnation:** When a significant portion of your monthly income is going towards servicing high-interest debt, you have nothing left to save or invest. You are stuck in a financial holding pattern, working hard just to keep from falling further behind. You are unable to build wealth because your money is constantly being consumed by your past.

– **Mental and Emotional Toll:** Living with a large amount of debt is incredibly stressful. It can lead to feelings of shame, guilt, and hopelessness. It can cause friction in relationships and impact your physical health. The constant worry about making payments and the feeling of being trapped can be overwhelming.

The Blueprint for Escaping the Quicksand

Getting out of credit card debt requires a radical shift in mindset and a disciplined, aggressive strategy. It is a war, and you must fight it with intensity. Here is your battle plan:

- Stop the Bleeding. Immediately. You cannot get out of a hole if you are still digging. The first and most important step is to stop using your credit cards for any new purchases. Switch to using a debit card or cash for all your spending. This can be a difficult adjustment, but it is non-negotiable. You must break the cycle of adding to the debt.

- Know Your Enemy: List All Your Debts. You cannot fight what you cannot see. Create a spreadsheet and list all of your credit card debts. For each card, list the total balance, the interest rate (APR), and the minimum monthly payment. This can be a painful and shocking exercise, but it is essential for creating a plan.

- Choose Your Attack Method: Avalanche or Snowball. There are two primary strategies for paying off multiple debts:

– **The Avalanche Method (Mathematically Optimal):** You make the minimum payment on all your cards except for the one with the highest interest rate. You throw every extra real you can find at that high-interest card. Once it is paid off, you take the entire amount you were paying on that card and apply it to the card with the next-highest interest rate. This method saves you the most money in interest over time.

– **The Snowball Method (Psychologically Powerful):** You make the minimum payment on all your cards except for the one with the smallest balance. You attack that smallest debt with everything you’ve got. Once it is paid off, you get a quick, motivating win. You then take the money you were paying on that debt and roll it into the next-smallest balance. This method provides powerful psychological reinforcement and can help you stay motivated.

Both methods work. Choose the one that you are most likely to stick with. - Increase Your Payments. Radically. The minimum payment is your enemy. You must pay more, and as much more as you possibly can. Scrutinize your budget and cut all non-essential spending. Every real you save by not eating out, canceling a subscription, or avoiding an impulse purchase is another soldier in your army against debt. Consider temporary measures to increase your income, like freelancing, selling items, or taking on a side hustle, and dedicate 100% of that extra income to your debt repayment plan.

- Consider a Balance Transfer or Consolidation Loan. If you have a good credit score, you may be able to qualify for a balance transfer credit card with a 0% introductory APR for a period of 12-21 months. This can be a powerful tool, as it allows you to pay down your principal without accruing interest. Be aware of the transfer fees (typically 3-5%) and make sure you have a plan to pay off the entire balance before the introductory period ends. Alternatively, a personal loan from a bank or credit union may offer a lower interest rate than your credit cards, allowing you to consolidate your debt into a single, more manageable payment.

Escaping the credit card debt cycle is a marathon, not a sprint. It requires sacrifice, discipline, and a relentless focus on the goal. But the freedom that awaits on the other side is immeasurable. It is the freedom from stress, the freedom to build wealth, and the freedom to finally have your money work for you, not against you.

Habit 4: The “I’ll Start Saving Later” Procrastination: Wasting Your Most Valuable Asset

Of all the lies we tell ourselves, “I’ll start saving and investing later” is perhaps the most financially devastating. It’s a habit rooted in the universal human tendency to prioritize the present over the future. We believe that our future selves will be richer, more disciplined, and better equipped to handle financial responsibilities. This procrastination feels harmless. After all, what’s the rush? Retirement is decades away. The problem with this logic is that it ignores the single most powerful force in the universe of finance: **compound interest**. By delaying, you are not just wasting time; you are squandering your most valuable financial asset and making your journey to wealth exponentially harder.

The Eighth Wonder of the World: Compounding in Action

Albert Einstein is often quoted as having called compound interest the eighth wonder of the world, stating, “He who understands it, earns it; he who doesn’t, pays it.” When you carry credit card debt, you are painfully paying it. When you invest, you have the incredible opportunity to earn it. Compounding is the process where your investment returns start generating their own returns. It’s a snowball effect for your money.

Let’s look at a simple, powerful example. Consider two friends, Ana and Beatriz, both 25 years old.

– **Ana** starts investing BRL 500 per month at age 25 and stops completely at age 35. She invests for just 10 years, for a total contribution of BRL 60,000.

– **Beatriz** procrastinates. She starts investing the same BRL 500 per month at age 35 and continues diligently until she retires at age 65. She invests for 30 years, for a total contribution of BRL 180,000.

Assuming a conservative 7% average annual return, who has more money at age 65? The answer is staggering. **Ana**, who only invested for 10 years, will have approximately **BRL 1.1 million**. **Beatriz**, who invested three times as much money over a much longer period, will only have approximately **BRL 610,000**.

Ana’s money had 40 years to grow and compound. Beatriz’s money only had 30. That first decade of growth was so powerful that Beatriz could never catch up, no matter how much more she invested. This is the brutal, unforgiving mathematics of procrastination. Every year you wait to start investing is a year of compound growth that you can never get back. The money you invest in your 20s is, by far, the most powerful and valuable money you will ever have.

The Psychological Traps of Delay

Why do so many people fall into this trap, even when the math is so clear?

– **Perfectionism and Analysis Paralysis:** The world of investing seems complex and intimidating. Many people feel they need to be experts before they can start. They spend years “researching” and waiting for the “perfect” time to invest, paralyzed by the fear of making a mistake. In reality, the best time to invest was yesterday. The second-best time is today. Starting with a simple, diversified investment is infinitely better than not starting at all.

– **Present Bias:** Our brains are hardwired to value immediate rewards over future ones. The tangible pleasure of spending BRL 500 today on a new gadget or a fancy dinner feels much more real and satisfying than the abstract concept of having that money grow for your future self, 40 years from now. It takes conscious effort and discipline to override this innate bias.

– **Unrealistic Expectations of Future Income:** We often overestimate how much more money we will be making in the future. We think, “Once I get that promotion, I’ll start saving aggressively.” But when the promotion comes, lifestyle inflation often kicks in. The new car, the bigger apartment, and the more expensive vacations eat up the extra income, and the savings goal gets pushed back again.

The Blueprint for Becoming a Future-Focused Investor

Overcoming this habit is about making the future feel more real and making the act of saving and investing as easy and automatic as possible.

- Automate, Automate, Automate:** This is the golden rule of building wealth. You should never have to rely on willpower to save money. Set up an automatic transfer from your checking account to your investment or retirement account for the day after you get paid. Treat your savings and investments like any other bill that must be paid. This “pay yourself first” method ensures that the money is invested before you even have a chance to miss it.

- Start Small, But Start Now:** You do not need a large sum of money to start investing. You can start with as little as BRL 50 or BRL 100 a month. The habit is more important than the amount in the beginning. The act of setting up the account, making the first transfer, and seeing your money at work, no matter how small, breaks the cycle of procrastination and builds momentum.

- Embrace Simplicity: Use Index Funds or ETFs:** You do not need to be a stock-picking genius. For the vast majority of people, the best approach is to invest in low-cost, diversified index funds or exchange-traded funds (ETFs). These funds hold a small piece of hundreds or thousands of different companies, giving you broad market exposure and instant diversification. It’s the simplest and most effective way to capture the long-term growth of the market.

- Maximize Your Retirement Accounts:** If your employer offers a retirement plan, especially one with a matching contribution, you must take advantage of it. An employer match is free money. Not contributing enough to get the full match is like turning down a raise. These accounts also offer significant tax advantages, allowing your money to grow even faster.

- Make Your Goals Concrete:** The future is an abstract concept. Make it concrete. Use an online retirement calculator to see exactly how much you need to save to reach your goals. Give your savings accounts specific names, like “Dream Vacation Fund” or “House Down Payment.” The more real and vivid you can make your future goals, the easier it will be to make the short-term sacrifices necessary to achieve them.

Time is a non-renewable resource. In finance, it is the ultimate amplifier. The habit of procrastination is a quiet thief that steals your future prosperity. By understanding the power of compounding and taking immediate, automated action, you can turn time into your greatest ally and build a future of financial freedom that your younger self would be proud of.

Habit 5: The No-Budget Blindfold: Flying Financially Blind

Attempting to manage your finances without a budget is like trying to navigate a cross-country road trip without a map or GPS. You might have a vague idea of your destination—financial security, perhaps—but you have no clear path to get there. You’ll take wrong turns, waste fuel, and likely end up lost and frustrated. A budget is not a financial straitjacket designed to restrict your fun; it is a tool of empowerment. It is a conscious plan that gives every single one of your reais a specific job to do. Living without a budget is a habit of ignorance, and it is the root cause of the most common financial question people ask themselves: “Where did all my money go?”

The Myth of the Restrictive Budget

Many people resist the idea of budgeting because they associate it with deprivation and penny-pinching. They believe it means they can never eat out, go on vacation, or enjoy life. This is a fundamental misunderstanding. A budget is not about restriction; it is about intention. It is the process of consciously aligning your spending with your values and goals. A good budget doesn’t tell you that you *can’t* spend money on a vacation; it gives you a clear plan for *how* to save for that vacation without accumulating debt or sacrificing your other financial priorities. It replaces guilt and anxiety with control and confidence.

Operating without a budget means you are making financial decisions in a vacuum, based on how much money is in your checking account at that moment. This is a recipe for disaster. It leads to a constant cycle of earning and spending with no forward momentum. You are financially adrift, tossed about by the currents of daily expenses and impulse purchases, with no anchor to hold you steady.

The Destructive Consequences of Financial Ignorance

When you don’t track your income and expenses, you are blind to the financial realities of your own life. This blindness has severe consequences:

– **Unidentified Financial Leaks:** You are likely wasting hundreds or even thousands of reais every month on things you don’t even realize. The daily coffees, the lunches out, the subscriptions you forgot you had—these small leaks can add up to a torrent of wasted money. A budget shines a bright light on these leaks, allowing you to plug them and redirect that money towards your goals.

– **Inability to Optimize:** Without data, you cannot make informed decisions. You might be spending a huge portion of your income on a category like transportation, but without tracking it, you would never know to explore cheaper alternatives like public transit or carpooling. A budget provides the data you need to optimize your spending and get the most value out of your money.

– **Constant Financial Stress:** The feeling of not knowing where your money is going is a huge source of stress. Every purchase is tinged with a bit of anxiety. Will I have enough to cover the bills at the end of the month? Can I really afford this? A budget eliminates this uncertainty. It gives you permission to spend on the things you’ve planned for, guilt-free.

– **Relationship Conflict:** Money is one of the leading causes of conflict in relationships. When there is no shared plan or agreement on how money should be spent, it can lead to constant arguments, resentment, and a lack of trust. Creating a budget together is a powerful act of communication and teamwork that can strengthen a relationship.

The Blueprint for Creating a Budget You’ll Actually Use

The best budget is the one you can stick to. It doesn’t need to be complicated. The goal is to create a simple, sustainable system that gives you clarity and control. Here are a few popular and effective methods:

- The 50/30/20 Rule (A Great Starting Point):** This is a simple and intuitive framework for beginners. You divide your after-tax income into three categories:

– **50% for Needs:** This includes all your essential expenses: housing, utilities, transportation, groceries, insurance, and minimum debt payments.

– **30% for Wants:** This is for your lifestyle choices: dining out, entertainment, hobbies, shopping, and vacations. This is the “fun” bucket.

– **20% for Savings and Debt Repayment:** This is the most important category. It includes building your emergency fund, investing for retirement, and paying off debt above the minimum payments.

This framework provides a clear, high-level guide for your spending. - Zero-Based Budgeting (For Maximum Control):** In this system, you give every single real a job. You start with your monthly income and then assign every bit of it to a specific category (expenses, savings, investments) until the total equals zero. Income – Expenses – Savings – Investments = 0. This method is more detailed and requires more active management, but it is incredibly effective for optimizing your spending and ensuring that no money is wasted. Apps like YNAB (You Need A Budget) are built on this philosophy.

- The “Pay Yourself First” Method (The Anti-Budget):** If you truly hate the idea of tracking every expense, this method can be a good compromise. You decide on your savings and investment goals first. Then, you automate the transfer of that money out of your checking account the day you get paid. The rest of the money is yours to spend as you wish. This ensures that you are meeting your most important financial goals, but it provides less control over your day-to-day spending and may not be effective for those who tend to overspend.

How to Get Started Today:

1. **Track Your Spending for One Month:** You can’t create a realistic budget until you know where your money is actually going. For the next 30 days, track every single expense. You can use a notebook, a spreadsheet, or a budgeting app like Mint or Mobills. Be honest and thorough. This will be an eye-opening experience.

2. **Analyze and Categorize:** At the end of the month, categorize your spending into groups (e.g., housing, food, transportation, entertainment). Compare your spending to a framework like the 50/30/20 rule. Where are you overspending? Where can you cut back?

3. **Create Your First Budget:** Based on your analysis, create your first forward-looking budget for the next month. Be realistic. A budget that is too restrictive is destined to fail. The goal is progress, not perfection.

4. **Review and Adjust:** A budget is not a static document. It is a living, breathing plan that should be reviewed and adjusted regularly. Check in at least once a month to see how you are doing and make changes as your income or expenses change.

A budget is the compass that will guide you on your financial journey. It transforms money from a source of stress and confusion into a powerful tool for building the life you desire. The habit of living without a budget is a choice to remain in the dark. The habit of budgeting is a choice to step into the light of financial clarity and control.

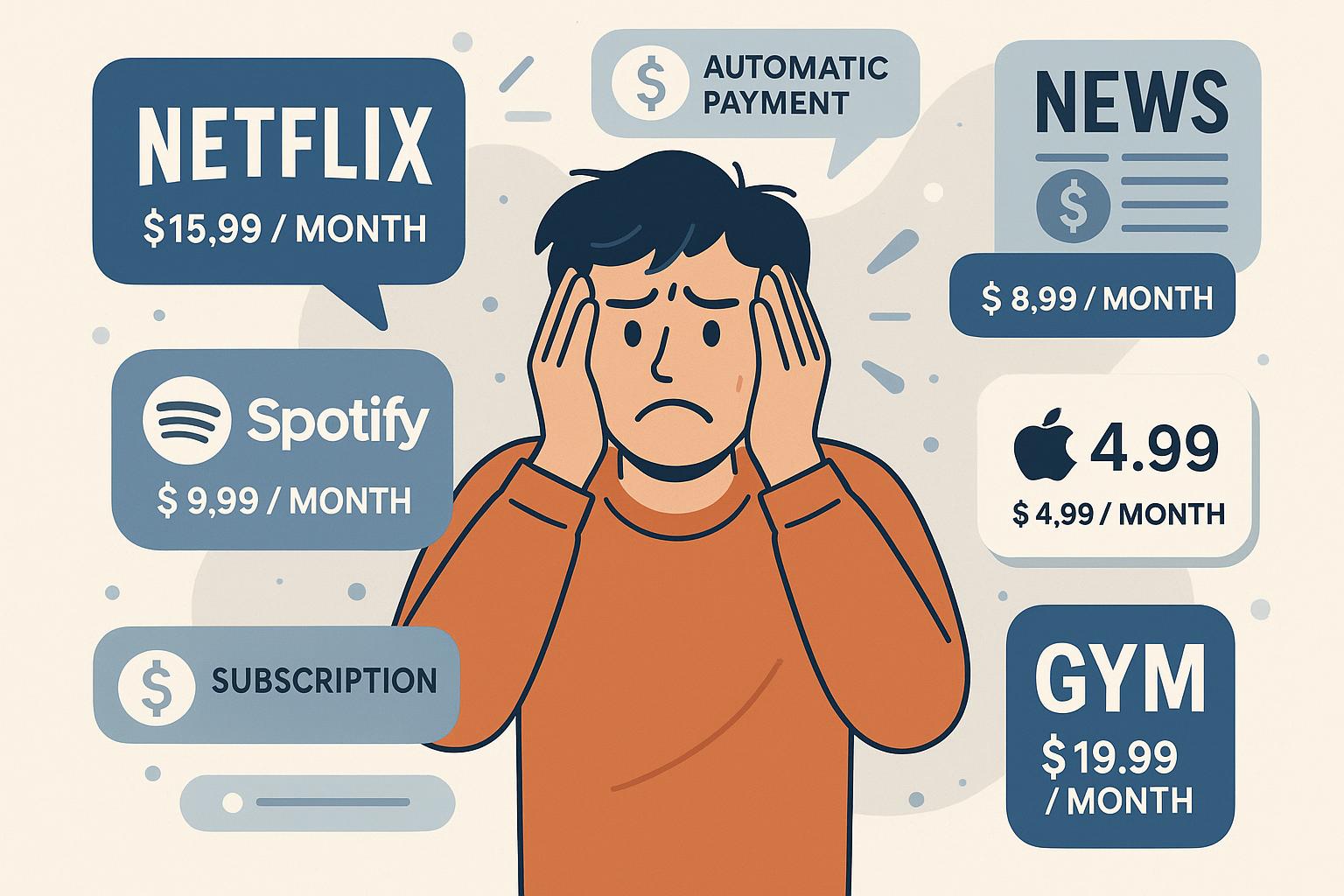

Habit 6: The Subscription Overload: Death by a Thousand Monthly Cuts

In the modern digital economy, the subscription model has become king. From streaming services and software to meal kits and gym memberships, companies have discovered the power of the small, recurring monthly payment. This business model is brilliant for them, as it creates a predictable stream of revenue. For the consumer, however, it has created a new and insidious financial habit: the slow, almost invisible drain of subscription overload. Each individual charge seems small and justifiable—BRL 15.99 for a music service, BRL 39.90 for a streaming platform, BRL 9.99 for a news app. But when multiplied across dozens of services, these tiny cuts can bleed your budget dry, a phenomenon often referred to as “death by a thousand cuts.”

The Psychology of the “Set It and Forget It” Trap

The power of the subscription model lies in its ability to bypass our natural spending defenses. Unlike a large, one-time purchase that forces us to pause and consider the cost, a small monthly subscription flies under the radar. Here’s why this model is so effective at separating us from our money:

- Low Barrier to Entry: Many services offer a free trial or a very low introductory price. This makes it incredibly easy to sign up without much thought. We think, “I’ll just try it out and cancel if I don’t use it.” But life gets busy, and we often forget.

- Automatic Renewal: This is the cornerstone of the subscription trap. The payments are automatic. They happen in the background without any action required on our part. This “set it and forget it” nature means that we can continue paying for services we no longer use or value for months, or even years, without ever realizing it.

- The “Utility” Illusion: We often justify subscriptions by convincing ourselves that they are essential utilities. We “need” multiple streaming services for entertainment, a music app for the gym, and various software for work. While some may be genuinely useful, many are simply luxuries that we have reclassified as necessities.

- The Pain of Cancellation: Companies often make the cancellation process intentionally difficult and confusing. They hide the cancellation button deep within account settings, force you to call a customer service number, or tempt you with special “retention” offers. This friction is designed to make you give up and just let the subscription continue.

The Hidden Financial Devastation

The danger of subscription overload is not the cost of any single subscription, but the cumulative impact of all of them. A quick audit of your bank or credit card statement can be a shocking experience. It’s not uncommon for people to discover they are spending hundreds of reais every month on a collection of services they barely use. This is money that is being completely wasted, money that could be accelerating your debt repayment, boosting your investments, or funding your life goals.

This habit is a perfect example of mindless spending. Because the payments are automated, we are not making a conscious decision to spend that money each month. The decision was made once, perhaps years ago, and the financial consequences continue on autopilot. It represents a complete loss of financial intention. Furthermore, it creates a bloated and inflexible budget. A large portion of your monthly income is already spoken for before you even have a chance to make conscious spending decisions. This reduces your financial agility and makes it harder to adapt to unexpected expenses or opportunities.

The Blueprint for a Subscription Detox

Reclaiming control over your subscriptions requires a systematic and ruthless audit. It’s time to separate the essential from the forgotten and the valuable from the wasteful.

- Conduct a Full Audit. Now. This is the first and most important step. Go through your last three months of bank and credit card statements with a fine-tooth comb. Highlight every single recurring payment. Create a spreadsheet and list them all: the name of the service, the monthly cost, and the annual cost. The total annual cost is often the number that provides the biggest shock and the strongest motivation to act.

- The “Keep, Cut, or Question” Method: Go down your list and, for each subscription, ask yourself a series of honest questions. Place each subscription into one of three categories:

– **Keep:** This is for the services you use regularly and that provide significant value to your life. This might be the one streaming service your whole family watches every night, or the professional software that is essential for your job. Be honest and strict. The “Keep” list should be very short.

– **Cut:** This is for the services you clearly do not use or need. The gym membership you haven’t used in six months, the streaming service you only signed up for to watch one show, the app you forgot you even had. Cancel these immediately and without hesitation.

– **Question:** This is for the gray area. The services you use occasionally but are not sure if they are worth the cost. For these, you have two options: 1) Try to find a cheaper or free alternative. Can you use the free version of a music app? Can you borrow e-books from your local library instead of paying for an audiobook subscription? 2) If no alternative exists, cancel the service for a trial period of one or two months. If you genuinely miss it and feel its absence, you can always resubscribe. More often than not, you will find that you don’t miss it at all. - Master the Art of the Annual Review: A subscription audit should not be a one-time event. Set a calendar reminder to conduct a full review of all your subscriptions at least once a year. This will prevent new, unnecessary services from creeping back into your budget.

- Use a Single Card for Subscriptions: Consider using a single credit or debit card for all your recurring payments. This makes the auditing process much easier, as all the charges will be in one place. It also allows you to see the total monthly cost at a glance.

- Embrace the “On-Demand” Mindset: Instead of maintaining multiple streaming subscriptions simultaneously, consider rotating them. Subscribe to one service for a month, binge-watch the shows you want to see, and then cancel it and move on to the next one. This allows you to access a wide variety of content for a fraction of the cost of keeping them all active at once.

Subscription overload is a modern financial malady, but it is one that is entirely within your control. By shifting from a passive, “set it and forget it” mindset to an active, intentional approach, you can slay this silent budget killer. Every subscription you cut is a raise you give yourself, freeing up cash flow to build the financial life you truly desire, not the one that subscription companies have designed for you.

Habit 7: The Lifestyle Inflation Trap: The Golden Handcuffs of a Higher Income

For many people, getting a raise or a promotion feels like the ultimate financial victory. It’s the moment they’ve been working towards, the reward for their hard work and dedication. They imagine that this extra income will be the key to solving their financial problems, allowing them to finally get ahead, save more, and feel secure. In a cruel twist of financial irony, however, the opposite often happens. Instead of building wealth, the new, higher income is quickly consumed by a new, more expensive lifestyle. This phenomenon is known as **lifestyle inflation**, and it is one of the most subtle and dangerous habits that can destroy your financial life. It’s the reason why so many high-income earners—doctors, lawyers, executives—still live paycheck to paycheck, trapped in what is often called “the golden handcuffs.”

The Insidious Creep of “More”

Lifestyle inflation doesn’t happen overnight. It’s a slow, insidious creep. When your income was lower, you were perfectly happy in your small apartment, driving your modest car, and vacationing locally. But with the new raise comes a new set of expectations, both internal and external. The thought process goes something like this:

– “I’ve worked hard; I deserve a nicer car.”

– “Now that I’m a manager, I should probably live in a better neighborhood.”

– “All my colleagues have a vacation home; maybe we should start looking for one too.”

– “We can afford to eat out at nicer restaurants now.”

Each individual upgrade seems reasonable and justified. You can, after all, “afford” the new monthly payment. The problem is that these upgrades all happen at once, and they come with a host of secondary expenses. The bigger house comes with higher property taxes, more expensive utilities, and more rooms to furnish. The luxury car comes with higher insurance premiums and more expensive maintenance. The new, more expensive lifestyle quickly expands to meet, and often exceed, the new income. Before you know it, you are in the exact same financial position as before—living paycheck to paycheck—but now you are trapped by a much higher level of fixed expenses. You have more stuff, but no more freedom.

The Psychological Drivers of Lifestyle Inflation

This habit is deeply rooted in human psychology and social dynamics:

– **The Hedonic Treadmill:** This is the psychological theory that humans have a tendency to quickly return to a relatively stable level of happiness despite major positive or negative life events. A raise provides a temporary boost in happiness, but we quickly adapt to the new income and the new lifestyle. The new car becomes just “the car.” The big house becomes just “the house.” To get the same happiness boost, we need another upgrade, another hit of “more.” It’s a never-ending treadmill of consumption.

– **Social Comparison (Keeping Up with the Joneses):** As you move up the career ladder, you are surrounded by a new peer group. You see what they have, where they live, and where they travel. There is immense social pressure, both real and perceived, to conform to the norms of this new group. It’s a natural human desire to fit in, but when it dictates your spending, it becomes a powerful engine of lifestyle inflation.

– **Mental Accounting and Justification:** We create mental justifications for our spending. We tell ourselves that we have “earned” this new lifestyle. While it’s important to celebrate success, this can become a dangerous blank check for unchecked spending. We fail to do the math and see that the cumulative effect of all these “deserved” upgrades is financial stagnation.

The Blueprint for Escaping the Golden Handcuffs

The key to defeating lifestyle inflation is to create a plan for your new income *before* it arrives. You must be proactive, not reactive. When you know a raise or a bonus is coming, you must decide in advance where that money will go.

- The 50/50 Rule for New Income:** This is a simple but incredibly powerful rule. For every new real of after-tax income you receive from a raise, commit to saving and investing at least 50% of it. The other 50% is yours to enjoy. This allows you to upgrade your lifestyle and feel the reward of your hard work, but it ensures that your savings rate is growing just as fast, if not faster, than your spending. For example, if you get a raise that increases your monthly take-home pay by BRL 1,000, immediately automate a new BRL 500 transfer to your investment account. The remaining BRL 500 can be used to enhance your current lifestyle. This creates a perfect balance between enjoying the present and building for the future.

- Prioritize Your Freedom Number:** Your ultimate financial goal is not a bigger house or a faster car; it is freedom. It is reaching the point where work becomes a choice, not a necessity. This is often called your “Financial Independence (FI) number,” which is typically calculated as 25 times your annual expenses. Before you upgrade your lifestyle, think about how that new recurring expense will increase your FI number and push your freedom date further into the future. Is that new car worth working an extra five years? Framing the decision in this way—as a direct trade-off between a material possession and your time and freedom—can be a powerful motivator to keep your spending in check.

- Practice Stealth Wealth:** Resist the urge to display your wealth. True wealth is not about what you spend; it’s about what you keep. It’s about having a robust investment portfolio, a fully-funded retirement account, and a zero-debt balance sheet. This is the stuff that buys you freedom and security, but it is invisible to the outside world. Find joy and satisfaction in the growth of your net worth, not in the admiration of others for your possessions. This internal validation is far more durable than external status symbols.

- Surround Yourself with the Right People:** If you are constantly surrounded by people who are obsessed with status and material possessions, it will be incredibly difficult to resist lifestyle inflation. Seek out friends and mentors who share your values, people who are more interested in financial independence, personal growth, and meaningful experiences than they are in the latest trends. Your social environment has a huge impact on your behavior. Choose it wisely.

- Focus on Experiences, Not Things:** Decades of psychological research have shown that spending money on experiences—like travel, concerts, or learning a new skill—provides more lasting happiness than spending money on material things. Before you upgrade a possession, consider if you could use that money for a memorable experience instead. The joy of a new gadget fades quickly, but the memories of a great trip can last a lifetime.

Lifestyle inflation is the final boss for many on their financial journey. It is the ultimate test of discipline and intention. By understanding the psychological traps and implementing a conscious plan to direct your new income, you can break free from the golden handcuffs. You can build a life where a higher income translates not just to more stuff, but to more freedom, more security, and more choices. That is the true definition of wealth.

Conclusion: From Destructive Habits to Financial Destiny

The journey through these seven destructive habits reveals a powerful and unifying truth: financial success is less about complex spreadsheets and stock market wizardry, and more about mastering your own behavior. The forces that seek to derail your financial life—impulse buying, debt, procrastination, lifestyle inflation—are all rooted in predictable psychological triggers and societal pressures. They are the default settings for a consumer culture that thrives on mindless spending. To build wealth is to consciously choose a different path. It is an act of rebellion against the default.

Breaking these habits is not a journey of deprivation, but one of empowerment. It is about transforming money from a source of anxiety and stress into a tool for liberation. Every time you resist an impulse purchase, you are casting a vote for your future self. Every real you divert from a high-interest credit card to an investment account is a brick in the foundation of your financial fortress. Every subscription you cancel is a small declaration of independence.

The path forward is clear:

1. **Embrace Awareness:** You cannot change what you do not acknowledge. Begin by tracking your spending, auditing your subscriptions, and listing your debts. This initial clarity, however uncomfortable, is the essential first step.

2. **Automate Your Success:** Willpower is a finite resource. Do not rely on it. Build a system of automatic transfers that pays your future self first. Make saving and investing the default, not an afterthought.

3. **Create Friction for Bad Habits:** Unsubscribe from marketing emails, delete saved credit card information from websites, and implement a 24-hour waiting period for non-essential purchases. Make it harder to do the wrong thing and easier to do the right thing.

4. **Focus on the “Why”:** Your financial goals must be connected to your deepest values. What kind of life do you want to live? What does freedom mean to you? A clear and compelling vision of your future is the most powerful fuel to overcome short-term temptations.

The journey to financial well-being is a marathon, not a sprint. There will be setbacks and mistakes along the way. The key is to not be discouraged, to learn from your errors, and to get back on track. By systematically identifying and dismantling these seven destructive habits, you can reclaim control over your money and, by extension, your life. You can move from being a passive participant in your financial story to being the active author of your financial destiny. The choice, as always, is yours.