The dream of homeownership is a cornerstone of financial stability and personal achievement for millions of Brazilians. Navigating the complex world of real estate financing, however, can be a daunting task. The Brazilian market presents two primary pathways to acquiring a property: the government-backed social housing program, Minha Casa, Minha Vida (MCMV), and the more conventional route of traditional financing through commercial banks. Each path has its own unique landscape of benefits, requirements, and potential pitfalls.

For many, the choice is not merely a financial one; it’s a decision that impacts long-term financial health, lifestyle, and the very nature of the home they will live in. Is it better to embrace the subsidies and lower interest rates of a government program, with its inherent restrictions? Or is the flexibility and broader choice offered by traditional lenders worth the higher costs and stricter requirements? This article provides a comprehensive, in-depth comparison of MCMV and traditional financing, designed to equip you with the knowledge to make an informed and confident decision on your journey to owning a home in Brazil.

Understanding the Brazilian Housing Landscape

Brazil, a country of continental dimensions, has long grappled with a significant housing deficit, particularly for its lower-income population. This challenge is not merely about a lack of houses, but a lack of affordable, well-located, and adequate housing. For decades, successive governments have implemented various policies to address this issue, with social housing programs playing a central role in the nation’s urban development strategy. These initiatives aim to provide a crucial social function, offering a ladder for families to achieve housing security and build equity, which would otherwise be unattainable in the open market.

The real estate market and its financing mechanisms are deeply intertwined with Brazil’s broader economic climate. Key factors such as the benchmark Selic interest rate, inflation, and overall economic growth directly influence the availability and cost of credit. In times of high interest rates, traditional financing can become prohibitively expensive, pushing more people towards subsidized programs like MCMV. Conversely, in a more stable, low-interest-rate environment, traditional financing becomes more competitive. Understanding this context is crucial for appreciating the distinct advantages and disadvantages of each financing option.

Deep Dive: The Minha Casa, Minha Vida (MCMV) Program

The Minha Casa, Minha Vida program stands as one of the most ambitious social housing initiatives in Brazil’s history. First launched in 2009 under President Luiz Inácio Lula da Silva’s administration, its primary objective has always been to reduce the country’s housing deficit by making homeownership accessible to low and moderate-income families. After a period of suspension, the program was revitalized in 2023 with renewed goals and expanded criteria, reaffirming its position as a cornerstone of Brazil’s social policy.

How MCMV Works: Subsidies and Tiers

The core mechanism of the MCMV program is the provision of substantial government subsidies and favorable financing conditions that are not available in the traditional market. The program is structured into different tiers, or ‘faixas’, based on the gross monthly income of the applicant families. This tiered approach allows the government to target support where it is most needed.

The most significant support is directed at ‘Faixa 1’ (Tier 1), which, under the revamped program, caters to families with a gross monthly income of up to BRL 2,640. For this group, the government can subsidize up to 95% of the property’s value, making the dream of homeownership a tangible reality for those with very limited financial resources. This level of subsidy is what makes MCMV a true social program, rather than just a financing line with slightly better rates.

For families with slightly higher incomes, the program offers other tiers with progressively lower subsidies but still highly advantageous conditions. For instance, families with incomes up to BRL 8,000 can still benefit from interest rates that are significantly lower than those offered by commercial banks. The program acts as a bridge, enabling families who are priced out of the traditional market to secure a foothold on the property ladder.

Advantages of the MCMV Program

The benefits of choosing the MCMV route are compelling, especially for first-time homebuyers in the lower-income brackets:

- Lower Interest Rates: This is perhaps the most significant financial advantage. MCMV offers interest rates that are consistently below the market average, directly translating into lower monthly payments and a lower total cost of the loan over its lifetime.

- Substantial Subsidies: The direct subsidies, particularly for the lowest income tier, can drastically reduce the principal amount that needs to be financed, making the loan much more manageable.

- Lower Down Payment Requirements: Traditional financing often requires a substantial down payment (typically 20% or more), which can be a major barrier for many families. MCMV significantly lowers this barrier, often requiring a much smaller initial outlay.

- Longer Repayment Periods: The program often allows for longer amortization periods, which helps to keep monthly installments affordable.

Disadvantages and Limitations of MCMV

Despite its clear advantages, the MCMV program is not without its limitations and potential drawbacks:

- Property Restrictions: The program imposes a cap on the value of the property that can be financed. This cap varies by city and region, but it generally limits choices to specific types of properties, often smaller apartments in new developments on the urban periphery.

- Limited Geographic Choice: Because the program is often tied to large-scale housing developments, buyers may have limited choices regarding location. These developments can sometimes be located far from urban centers, jobs, and established infrastructure, potentially leading to higher transportation costs and longer commutes.

- Bureaucracy and Wait Times: As a government program, the application and approval process for MCMV can be bureaucratic and time-consuming. There are often long waiting lists, and the process can be less agile than dealing with a private bank.

- Quality Concerns: While not always the case, some large-scale MCMV developments have faced criticism regarding the quality of construction and the lack of adequate surrounding infrastructure and public services.

The decision to pursue financing through MCMV requires a careful balancing of these pros and cons. For a family that meets the income requirements and for whom the lower cost is the absolute priority, it is an unparalleled option. However, for those seeking more flexibility, a wider choice of properties, or a more desirable location, the constraints of the program might lead them to consider the traditional financing market.

Deep Dive: Traditional Real Estate Financing

Traditional real estate financing represents the conventional path to homeownership, facilitated by private and public commercial banks, savings and loan associations, and other financial institutions authorized by the Central Bank of Brazil. Unlike the socially-oriented MCMV program, traditional financing operates on purely market-based principles. The terms of the loan—interest rates, down payment requirements, and repayment periods—are determined by the interplay of the broader economy, the bank’s own lending policies, and the individual borrower’s financial profile.

The Mechanics of Traditional Financing

When you seek traditional financing, the bank conducts a thorough analysis of your creditworthiness. This process is far more individualized than the tier-based system of MCMV. The key factors that will determine your eligibility and the terms of your loan include:

- Credit Score: A strong credit history is paramount. Lenders will scrutinize your payment history, existing debts, and overall financial behavior to assess the risk of default.

- Income Verification: You will need to provide comprehensive proof of a stable and sufficient income to cover the monthly mortgage payments. Banks typically have a rule that the mortgage payment cannot exceed a certain percentage (often around 30%) of your gross monthly income.

- Down Payment: This is a critical component. Most banks require a down payment of at least 20% of the property’s value. A larger down payment can result in better interest rates and a lower principal loan amount.

- Relationship with the Bank: Existing clients with a good banking history may be offered more favorable conditions as a loyalty incentive.

The interest rates in traditional financing are typically linked to Brazil’s benchmark interest rate, the Selic rate, plus a spread charged by the bank. This means that in a high-interest-rate environment, mortgages can become very expensive, whereas a falling Selic rate can make financing more accessible and affordable.

Advantages of Traditional Financing

The primary appeal of traditional financing lies in its flexibility and freedom of choice:

- Freedom to Choose Property: This is the most significant advantage. There are no restrictions on the type, value, or location of the property you can buy, as long as you can afford it. You can choose a new or used home, an apartment or a house, in any neighborhood you desire.

- Negotiating Power: With a pre-approved loan from a bank, you have more negotiating power with sellers. You are essentially a cash buyer in their eyes, which can lead to better prices and terms.

- Faster Process: While still involving significant paperwork, the process of getting a loan from a private bank can often be faster and more streamlined than navigating the bureaucracy of a government program.

- Access to Different Loan Products: Banks offer a variety of mortgage products with different features, such as fixed or variable interest rates, which can be tailored to your financial strategy.

Disadvantages and Hurdles of Traditional Financing

The flexibility of traditional financing comes at a cost, and there are several hurdles to overcome:

- Higher Interest Rates: Without government subsidies, the interest rates are dictated by the market and will almost always be higher than those offered through the MCMV program.

- Substantial Down Payment: The requirement for a significant down payment (typically 20% or more) is often the biggest obstacle for first-time homebuyers. Saving up this amount can take years.

- Stricter Credit Requirements: Banks have very strict criteria for credit approval. A less-than-perfect credit score or an unstable income stream can easily lead to a loan denial.

- Market Volatility: Your mortgage is subject to the fluctuations of the economy. In periods of economic instability, interest rates can rise, and credit can become tighter, making it harder to secure a loan.

Head-to-Head Comparison: MCMV vs. Traditional Financing

Now that we have explored the individual characteristics of both the Minha Casa, Minha Vida program and traditional real estate financing, a direct, side-by-side comparison is essential to truly understand which path might be the best fit for your specific circumstances. The choice is not always straightforward, and the optimal solution depends on a complex interplay of your income, savings, life stage, and personal priorities.

To simplify this comparison, let’s break it down into the most critical factors that every prospective homebuyer must consider. Below is a summary table followed by a more detailed analysis of each point.

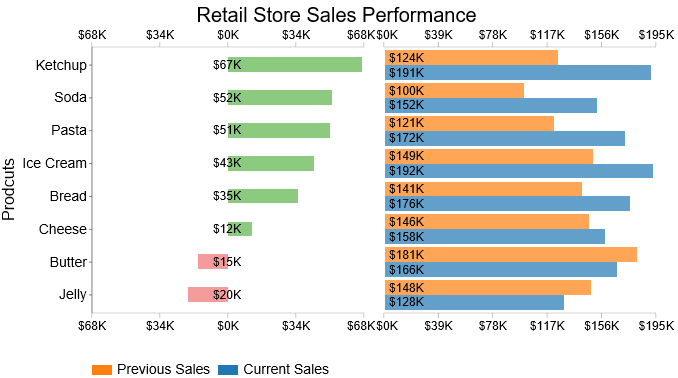

| Feature | Minha Casa, Minha Vida (MCMV) | Traditional Financing |

|---|---|---|

| Target Audience | Low to moderate-income families (specific income brackets, e.g., up to BRL 8,000/month). | Broader market, including middle and high-income individuals with no income ceiling. |

| Interest Rates | Significantly below market rates, subsidized by the government. | Market-based, linked to the Selic rate plus a bank spread. Generally higher. |

| Down Payment | Low to zero, especially for the lowest income tier. | Substantial, typically 20% or more of the property value. |

| Property Choice | Restricted to properties within a certain price cap, often new developments in specific areas. | Complete freedom. Any type, value, or location of property (new or used). |

| Approval Process | Bureaucratic, based on meeting program criteria. Can involve long wait times. | Based on individual credit analysis. Can be faster and more streamlined. |

| Flexibility | Low. Strict rules on income, property value, and usage. | High. More options for loan types, and freedom to sell or rent the property. |

In-Depth Analysis of Key Differences

1. The Cost of Money: Interest Rates and Subsidies

This is the most significant financial differentiator. MCMV is, at its heart, a subsidy program. The government uses public funds to buy down interest rates, making them artificially low. For a family on a tight budget, this is a game-changer. A difference of just a few percentage points in the interest rate can translate into tens or even hundreds of thousands of reais in savings over the life of a 30-year mortgage. Traditional financing simply cannot compete on this front. The rates offered by commercial banks are a reflection of the cost of money in the broader economy and the risk the bank is taking. While you can and should shop around for the best rate, it will be fundamentally a market rate, not a subsidized one.

2. The Barrier to Entry: Down Payment

The down payment is often the single greatest hurdle to homeownership. Saving up 20% of a property’s value can feel like an impossible task for many families, especially in major urban centers where property values are high. This is where MCMV offers another of its most powerful advantages. By requiring a very low (or sometimes no) down payment, it opens the door to homeownership for those who have a stable income to make monthly payments but lack the accumulated capital for a large initial investment. Traditional financing, on the other hand, views the down payment as a critical measure of the borrower’s commitment and financial discipline. It reduces the bank’s risk, and as such, it is a non-negotiable component of the loan.

3. Freedom vs. Affordability: Property Choice

Here, the tables turn dramatically in favor of traditional financing. The subsidies and low entry cost of MCMV come with a significant trade-off: a lack of choice. The program’s price caps mean that you are limited to a specific segment of the market. In many cities, this means choosing from a selection of newly constructed apartments in large developments, which may be located in peripheral neighborhoods. If your dream is a single-family home with a yard in a specific, well-established neighborhood, MCMV is unlikely to be the right vehicle for you. Traditional financing, in stark contrast, gives you the keys to the entire real estate market. As long as the bank appraises the property for the loan amount and you can afford the payments, you can buy whatever and wherever you want. This freedom to choose a home that perfectly fits your family’s needs and lifestyle is, for many, worth the higher cost.

4. The Human Factor: Who Are You?

Ultimately, the decision rests on a clear-eyed assessment of your own financial identity.

Are you a family with a modest but stable income, struggling to save a large sum for a down payment, and for whom the absolute lowest monthly payment is the highest priority? If so, the Minha Casa, Minha Vida program is almost certainly the superior choice. It was designed for you.

Are you a professional with a higher income, significant savings for a down payment, and a strong desire for a specific type of home in a particular location? Do you value flexibility and want to make a long-term real estate investment without government restrictions? If this describes you, then the freedom and choice offered by traditional financing will likely outweigh the cost savings of the MCMV program.

They are different tools designed for different purposes and different people. The key is to honestly assess your financial situation, your life goals, and your priorities to choose the tool that will best help you build your future.

Scenario Analysis: Putting Theory into Practice

To make the comparison even clearer, let’s walk through a few hypothetical scenarios. By examining the situations of different fictional families, we can see how the choice between MCMV and traditional financing plays out in the real world.

Scenario 1: The Silva Family – Starting Out

- Profile: A young married couple with one small child. Their combined gross monthly income is BRL 3,500. They have managed to save BRL 10,000, but find it difficult to save more due to rent and childcare costs.

- Goal: To stop paying rent and own their first home, providing stability for their child. Location is secondary to affordability.

Analysis: The Silva family is the quintessential candidate for the Minha Casa, Minha Vida program. Their income places them squarely within the program’s target demographic. The BRL 10,000 they have saved would be insufficient for the 20% down payment required for a traditionally financed property, which could easily be BRL 40,000 or more. With MCMV, their savings would be more than enough to cover any initial costs, and they would benefit from the lowest possible interest rates and significant subsidies. The trade-off of having limited choice in property and location is acceptable to them, as their primary goal is to escape the rent cycle and build equity. For the Silvas, traditional financing is not a viable option; MCMV is their only realistic path to homeownership.

Scenario 2: Ana – The Young Professional

- Profile: A single software developer, 28 years old, with a gross monthly income of BRL 9,000. She has been working for five years and has diligently saved BRL 80,000.

- Goal: To buy a modern one or two-bedroom apartment in a central, well-connected neighborhood close to her office and social life. She sees the property as both a home and a long-term investment.

Analysis: Ana’s situation is more nuanced. Her income is at the very top end or slightly above the MCMV program’s limits, meaning she would likely not qualify for significant subsidies, if any. More importantly, her desire for a specific type of property in a prime location makes MCMV a poor fit. The program’s property value caps would exclude the apartments in the neighborhoods she is interested in. For Ana, traditional financing is the clear winner. Her substantial savings of BRL 80,000 can serve as a strong down payment on a property valued at BRL 400,000. Her stable, high income and good credit history will make her an attractive candidate for a loan from a commercial bank. The higher interest rate is a price she is willing to pay for the freedom to choose a home that fits her lifestyle and investment goals. She can shop around different banks to find the best possible terms.

Scenario 3: The Costa Family – Upgrading

- Profile: A couple in their late 40s with two teenage children. Their combined gross monthly income is BRL 15,000. They own a small apartment (fully paid off) that they bought years ago and are now looking to sell it to buy a larger house with more space. The sale of their current apartment is expected to net them BRL 200,000.

- Goal: To purchase a three-bedroom house with a small yard in a good school district, valued at around BRL 600,000.

Analysis: The Costa family is completely outside the scope of the MCMV program. Their income is too high, and they are not first-time homebuyers. Their only option is traditional financing, and they are in a strong position to secure it. The BRL 200,000 from the sale of their old apartment serves as an excellent down payment (33% of the new property’s value), significantly reducing the amount they need to borrow. Their stable, high income and history of homeownership make them a low-risk borrower for any bank. They will be able to leverage their strong financial position to negotiate favorable terms on a BRL 400,000 mortgage to complete their purchase. This scenario highlights how traditional financing is the standard mechanism for those moving up the property ladder.

Making the Final Decision: Next Steps

Choosing between Minha Casa, Minha Vida and traditional financing is one of the most significant financial decisions you will ever make. The information in this article provides a comprehensive framework for understanding the pros and cons of each path, but the final choice must be a personal one, based on a rigorous and honest evaluation of your own circumstances.

Here are the practical next steps you should take:

- Detailed Financial Self-Assessment: Don’t rely on rough estimates. Create a detailed monthly budget to understand exactly how much you can comfortably afford for a mortgage payment. Use online calculators to simulate different loan scenarios with varying interest rates and terms. Get a clear picture of your total savings and what you can realistically use for a down payment and closing costs.

- Check Your Credit Score: Before you approach any lender, know where you stand. Obtain a copy of your credit report from services like Serasa or Boa Vista. If your score is low, take steps to improve it by paying off small debts and ensuring all your bills are paid on time. A higher credit score is your best negotiating tool in the traditional market.

- Simulate at the Bank: Go to the source. Visit the website or a branch of Caixa Econômica Federal, the primary operator of the MCMV program, to get a detailed simulation based on your income. At the same time, talk to a mortgage manager at one or two private banks (e.g., Itaú, Bradesco, Santander). Get a pre-approval or at least a realistic estimate of what they would be willing to lend you and at what terms.

- Explore the Market: Armed with these simulations, start looking at properties. See what your budget gets you in both the MCMV-eligible market and the open market. Does the reality of the available properties align with your expectations and needs? This step is crucial for moving from abstract numbers to a tangible vision of your future home.

Conclusion: A Tale of Two Brazils

The dual paths of Minha Casa, Minha Vida and traditional financing reflect the economic realities of Brazil itself. They represent two different approaches to a shared dream: the security and pride of homeownership.

Minha Casa, Minha Vida is a powerful engine of social mobility. It is a testament to the idea that homeownership should not be a privilege reserved for the wealthy, but a right accessible to all. For millions of families, it is not just the better option; it is the only option. It provides a structured, subsidized, and protected pathway to escape the precarity of renting and begin building generational wealth. The trade-offs in choice and flexibility are, for its target audience, a small price to pay for the life-changing opportunity it affords.

Traditional Financing, on the other hand, is the embodiment of market freedom. It empowers those with the financial means to navigate the open market and choose a home that perfectly aligns with their desires and ambitions. It is the vehicle for upward mobility, for moving from a first apartment to a larger family home, for investing in property in a prime location. It rewards financial discipline, a strong credit history, and the ability to accumulate capital. The higher costs and stricter requirements are the price of admission to a world of unlimited choice and flexibility.

Ultimately, neither system is inherently “better” than the other. They are different tools designed for different purposes and different people. The key is to honestly assess your financial situation, your life goals, and your priorities to choose the tool that will best help you build your future. By doing your homework, running the numbers, and understanding the fundamental trade-offs, you can navigate the Brazilian real estate market with confidence and turn the dream of your own home into a concrete reality.

This dual-market structure is a defining characteristic of Brazilian real estate. On one side, a government-driven, socially-focused market aims to correct historical inequalities and provide a basic right. On the other, a free-market system operates on the principles of risk, profit, and individual financial capacity. The tension and interplay between these two systems shape the opportunities and challenges for every prospective homebuyer in the country. This article will dissect these two worlds, providing the clarity needed to navigate them effectively.

The Historical Context of Brazil’s Housing Deficit

To fully grasp the significance of programs like MCMV, one must look back at Brazil’s history of rapid urbanization. Starting in the mid-20th century, a massive rural exodus led to the explosive growth of cities like São Paulo, Rio de Janeiro, and Belo Horizonte. This migration was not met with adequate urban planning or housing supply, leading to the proliferation of informal settlements, or favelas, on the peripheries of major metropolitan areas. These communities, while resilient and vibrant, often lack basic infrastructure such as sanitation, reliable electricity, and access to public services.

The housing deficit, therefore, is not just a quantitative problem but a qualitative one. It’s a complex issue rooted in decades of social inequality, insufficient public investment, and land speculation that has driven property prices in well-located urban areas to levels unattainable for the majority of the working population. Government housing policies prior to MCMV, such as the National Housing Bank (BNH) created in the 1960s, had mixed results and were often criticized for not reaching the poorest segments of society. The BNH system eventually collapsed in the 1980s amidst a severe economic crisis, leaving a policy vacuum that was only partially filled by smaller, localized initiatives until the creation of MCMV in 2009. This historical context underscores the monumental challenge that MCMV was designed to address and the reasons why it remains such a critical social policy tool.

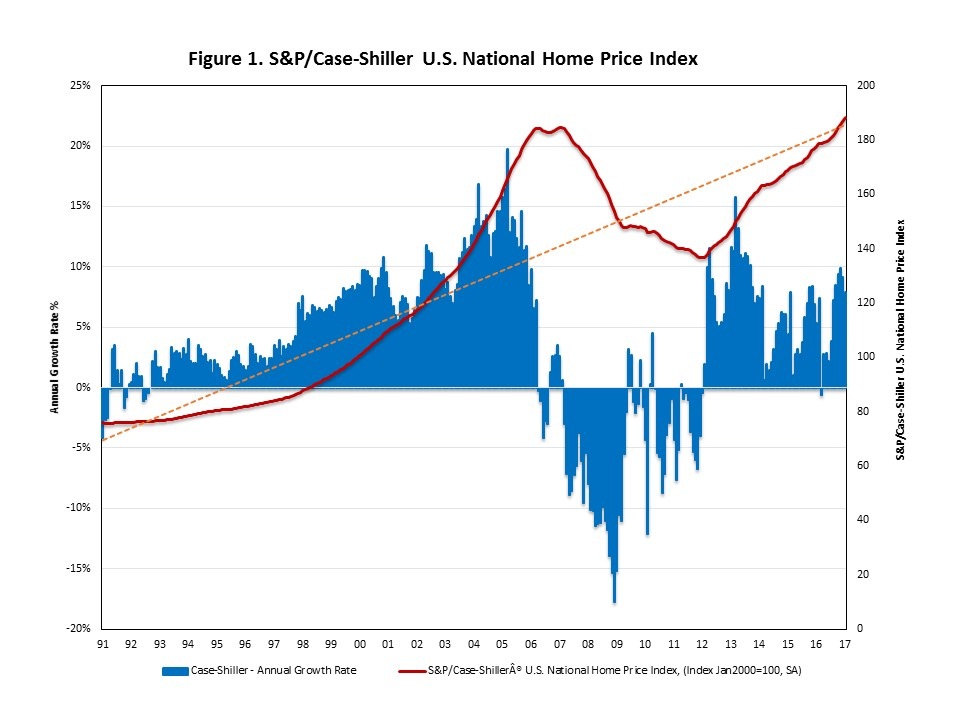

The Impact of the Selic Rate and Economic Cycles

The Brazilian real estate market is exceptionally sensitive to the country’s macroeconomic cycles, with the Selic rate, the benchmark interest rate set by the Central Bank’s Monetary Policy Committee (COPOM), acting as the primary lever. The Selic rate is the main tool used by the Central Bank to control inflation. When inflation is high, the COPOM raises the Selic rate to cool down the economy, which directly increases the cost of borrowing for commercial banks. These banks, in turn, pass on the higher costs to consumers in the form of higher interest rates on mortgages, car loans, and credit cards.

For a prospective homebuyer considering traditional financing, a high Selic rate can be a deal-breaker. A mortgage that might have been affordable when the Selic was at a historic low of 2% can become completely out of reach when it climbs into the double digits. This volatility makes long-term financial planning difficult and creates a boom-and-bust cycle in the real estate market. It is precisely this volatility that makes the stable, subsidized, and predictable interest rates of the MCMV program so attractive. By decoupling the interest rate from the fluctuations of the market, MCMV provides a layer of insulation and security for low-income families, allowing them to plan for the long term without fear of sudden economic shocks derailing their homeownership dream.

A Closer Look at the Financial Engineering of MCMV Advantages

The financial benefits of the MCMV program are not just marginal; they represent a fundamental restructuring of the cost of homeownership for its beneficiaries. Let’s delve deeper into how these advantages are engineered and what they mean in practical terms.

The Power of Subsidized Interest Rates: To illustrate the impact, consider a hypothetical BRL 200,000 loan over 30 years. A traditional mortgage might carry an interest rate of 11% per year, while an MCMV loan for a similar-profile borrower could be as low as 5% or 6%. With the traditional loan, the total interest paid over the 30 years would be astronomical, potentially more than double the original loan amount. With the MCMV loan, the total interest paid would be dramatically lower. This isn’t just about a lower monthly payment; it’s about a massive reduction in the total cost of acquiring the asset. This difference in total cost is wealth that stays in the family’s pocket, available for education, healthcare, or other investments, rather than being transferred to a bank as interest profit. The government is effectively using its financial power to absorb a large portion of the interest cost, a benefit that no private institution can or will offer.

The Role of the FGTS in Down Payments: Another powerful tool often used in conjunction with MCMV is the Fundo de Garantia do Tempo de Serviço (FGTS). This is a mandatory savings fund into which employers deposit a percentage of an employee’s salary each month. Brazilian workers can use the accumulated balance in their FGTS account to make a down payment on a home, reduce the principal of an existing mortgage, or cover part of the monthly payments. While the use of FGTS is also permitted in some traditional financing, it is a cornerstone of the MCMV program. For many families, their FGTS balance is the only significant source of capital they have. The ability to unlock these funds and apply them directly to their home purchase, combined with the low down payment requirements of MCMV, creates a powerful synergy that makes homeownership possible for millions of formal-sector workers.

Security and Predictability: Beyond the raw numbers, MCMV offers a level of psychological security. The fixed, low interest rates are predictable for the entire duration of the loan. This protects families from the often-violent swings of the Brazilian economy and the Selic rate. A family knows exactly what their mortgage payment will be in 5, 10, or 20 years, allowing for true long-term financial planning. This predictability is a luxury that borrowers in the traditional market, especially those with variable-rate mortgages, do not have. This stability is a crucial, though often overlooked, advantage of the program.

This journey, whether through the structured support of a government program or the open freedom of the market, is a defining experience in the life of a Brazilian family. It is a path paved with documents, simulations, and difficult choices, but it leads to a destination of unparalleled value: a place to call home. The Brazilian dream of homeownership is alive and well, and with the right information and a clear understanding of the available tools, it is a dream that is within reach for more people than ever before.