In the fast-paced and often volatile world of cryptocurrency, milestones are both celebrated and scrutinized. They serve as powerful indicators of momentum, sentiment, and underlying value. Recently, the crypto community turned its attention to one of the industry’s titans, as Binance Coin (BNB) shattered its previous records, surging to a new all-time high of over $1,087. This remarkable achievement is not just a victory for BNB holders; it is a significant event that sends ripples across the entire digital asset landscape. The surge has pushed BNB’s market capitalization to a staggering $149 billion, eclipsing that of established legacy giants like Intel, a clear signal of the shifting tides in the global financial order.

This is more than just a number on a chart. BNB’s ascent is a complex story woven from multiple threads: a burgeoning and rapidly expanding ecosystem, a shifting regulatory climate that is growing increasingly favorable, and a potent dose of market speculation tied to the future of Binance’s influential co-founder, Changpeng “CZ” Zhao. As the native token of the world’s largest cryptocurrency exchange and the fuel for the sprawling BNB Chain ecosystem, BNB’s performance is often seen as a bellwether for the health and direction of the broader altcoin market and the DeFi sector.

This article provides a comprehensive deep dive into BNB’s historic rally. We will dissect the key factors driving its unprecedented growth, from the fundamental strengths of its ecosystem to the powerful narratives capturing the market’s imagination. We will explore what this milestone means for the wider crypto market, analyzing its impact on investor sentiment, the competitive landscape of smart contract platforms, and the growing institutional interest in digital assets. Finally, we will look to the future, examining the potential roadblocks and the ambitious price targets that analysts are now eyeing. Is this a temporary peak fueled by speculation, or is it the beginning of a new, sustained chapter of growth for one of crypto’s most important assets? Let’s explore the forces behind the numbers and what they signal for the future of finance.

The Anatomy of the Rally: Deconstructing BNB’s Surge to $1,087

A price surge of this magnitude is never the result of a single factor. Rather, it is a perfect storm, a convergence of powerful narratives, fundamental strengths, and favorable market conditions. BNB’s climb past the $1,000 mark was fueled by a potent cocktail of speculation, regulatory optimism, and undeniable ecosystem growth. Let’s break down the three core pillars that provided the thrust for this historic rally.

1. The “CZ Pardon” Narrative: A Powerful Dose of Speculation

In the world of crypto, narratives can be just as powerful as fundamentals, and few narratives have been as captivating as the potential pardon of Binance’s co-founder, Changpeng Zhao (CZ). After serving a four-month prison sentence following a multi-billion dollar settlement with U.S. authorities, speculation about his future has been rampant. The price of BNB has shown a direct and sensitive correlation to the perceived odds of a presidential pardon for CZ, as tracked on prediction markets like Polymarket. When the odds spiked to over 60% in mid-September, BNB’s price followed suit.

The market is interpreting a potential pardon as a major de-risking event for the entire Binance ecosystem. As Amanda He, CIO at ChainUp Investment, told Bloomberg, “The market believes that a pardon could help CZ, Binance, and BNB clear most regulatory concerns.” This sentiment was further amplified by a subtle but significant change in CZ’s X (formerly Twitter) bio, which was updated from “ex-@Binance” back to “@Binance,” a move many traders interpreted as a signal of his potential return to a more active role. While purely speculative, this narrative has acted as a powerful catalyst, drawing in momentum traders and igniting a wave of optimistic buying pressure.

2. A Warming Regulatory Climate: From Headwind to Tailwind

For years, the cryptocurrency industry has been hampered by regulatory uncertainty, particularly in the United States. However, the climate has shifted dramatically in 2025. The current administration has publicly embraced a pro-crypto stance, expressing a desire to make the U.S. a global hub for digital asset innovation. This shift from a confrontational to a more collaborative regulatory approach has been a major tailwind for the entire market, and BNB has been a prime beneficiary.

A clearer and more supportive regulatory framework reduces the risk for institutional investors and encourages mainstream adoption. The speculation around a CZ pardon is itself a product of this new environment. The belief that the administration may be willing to wipe the slate clean for a key industry figure like CZ signals a fundamental change in how regulators view the digital asset space. This has boosted confidence across the board, creating a fertile ground for growth and encouraging capital to flow back into major assets like BNB.

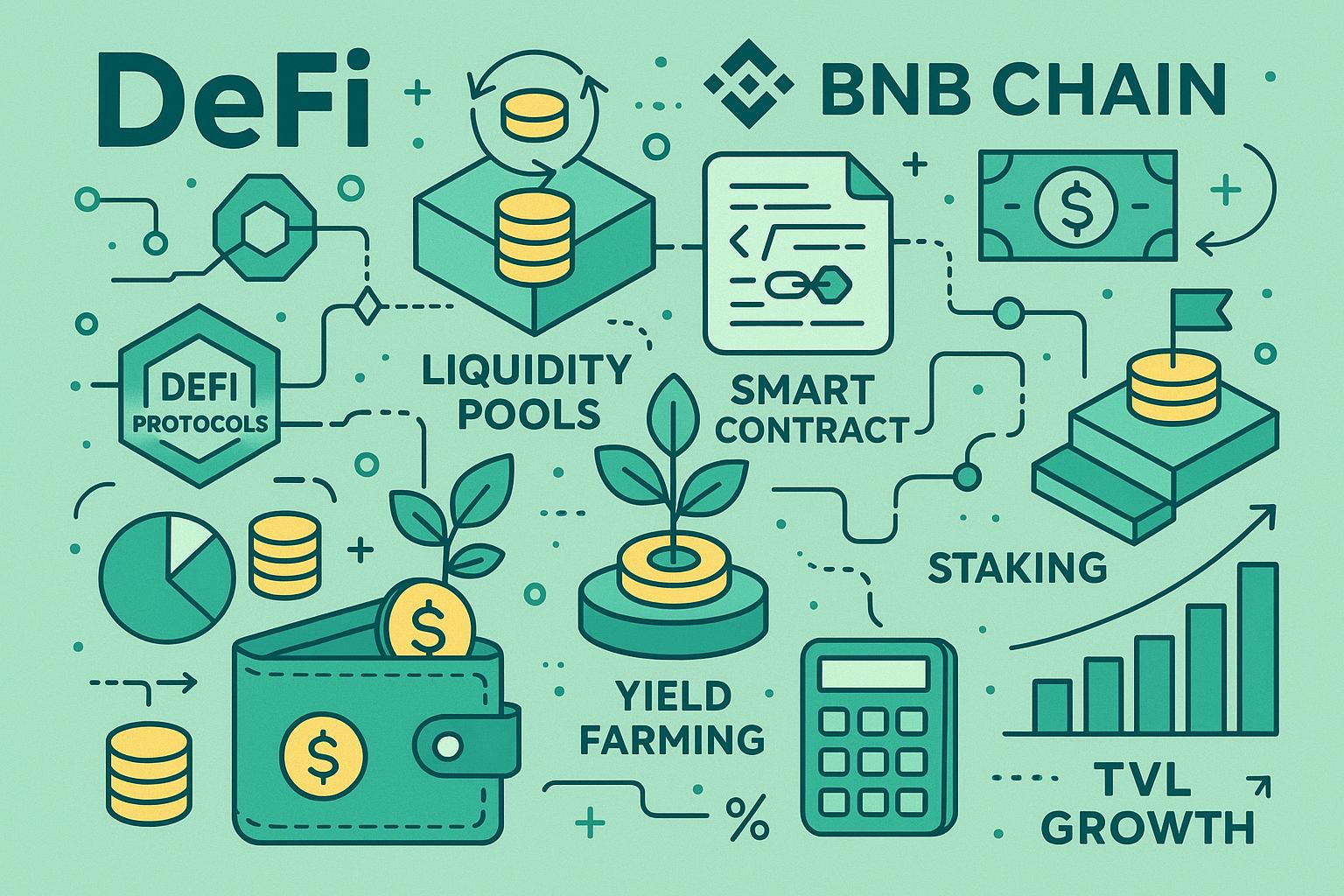

3. Unstoppable Ecosystem Growth: The Fundamental Bedrock

While narratives and regulatory shifts can create short-term price movements, a sustained rally requires a foundation of real growth and utility. This is where the BNB Chain ecosystem truly shines. The on-chain metrics from 2024 paint a picture of a vibrant and rapidly expanding network. The Total Value Locked (TVL) in the BNB Chain’s DeFi ecosystem surged by an impressive 58% to $5.5 billion, while the number of unique wallet addresses grew by over 17% to a massive 486 million. This demonstrates a clear and growing demand for the applications and services built on the network.

This growth is not accidental. It is the result of a concerted effort by the BNB Chain developers to enhance scalability, reduce transaction costs, and provide robust support for builders. The network’s high performance and EVM compatibility have made it a go-to platform for developers looking to build decentralized applications (dApps) that can reach a massive user base. This fundamental strength provides a solid bedrock for BNB’s valuation. Unlike purely speculative assets, BNB’s price is underpinned by the real economic activity happening within its sprawling ecosystem. The rally may have been sparked by speculation, but it is sustained by these undeniable fundamentals.

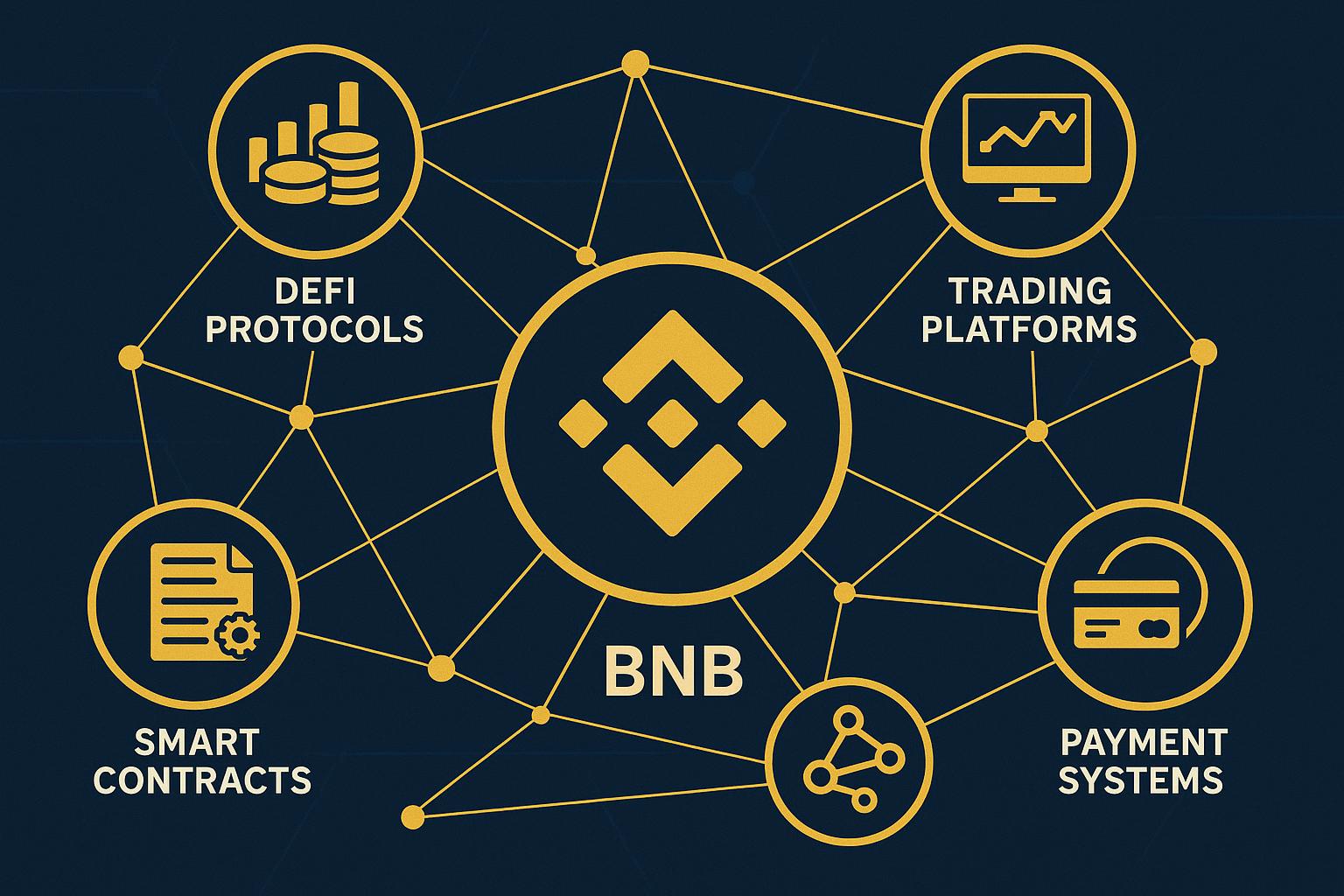

The Utility of BNB: Beyond the Exchange

To truly grasp the resilience and potential of BNB, one must look beyond its price chart and understand its deep-rooted utility. BNB is not merely a speculative asset; it is the lifeblood of a vast and multifaceted digital economy. Its value is derived from a wide array of use cases that span across the Binance ecosystem and the broader world of decentralized finance, making it one of the most versatile and widely used tokens in the crypto space.

Fueling the World’s Largest Exchange

At its origin, BNB was created as a utility token to offer discounts on trading fees on the Binance exchange. This initial use case remains a powerful driver of demand. Traders on Binance can opt to pay their trading fees in BNB and receive a significant discount, creating a constant and organic demand for the token from millions of users. This mechanism effectively ties the value of BNB to the trading volume of the world’s largest crypto exchange, creating a virtuous cycle: as Binance grows, so does the demand for BNB.

The Engine of the BNB Chain

With the launch of the Binance Smart Chain (now BNB Chain), the utility of BNB expanded exponentially. It became the native token of a high-performance blockchain, analogous to how ETH functions on the Ethereum network. Every transaction, every smart contract execution, and every deployment of a new dApp on the BNB Chain requires the payment of gas fees in BNB. This makes BNB an essential commodity for anyone looking to participate in the network’s burgeoning DeFi, NFT, and gaming ecosystems. With millions of daily active users and a massive volume of transactions, the demand for BNB as a gas token is substantial and growing.

A Cornerstone of Decentralized Finance (DeFi)

Within the BNB Chain’s DeFi ecosystem, BNB plays a central and multifaceted role. It is a primary asset used for:

- Liquidity Provision: Users can stake their BNB in liquidity pools on decentralized exchanges (DEXes) like PancakeSwap, earning a share of the trading fees.

- Collateral for Lending: BNB is widely accepted as collateral on lending and borrowing platforms, allowing users to take out loans against their holdings without having to sell them.

- Yield Farming: Many yield farming protocols on BNB Chain use BNB as a base asset or a reward token, allowing users to generate passive income on their holdings.

- Governance: In many DeFi protocols on the network, holding BNB or a derivative token grants users voting rights on the future development and direction of the protocol.

This deep integration into the fabric of DeFi ensures that as the ecosystem grows, the utility and demand for BNB grow in lockstep.

Powering Payments and More (PayFi)

The utility of BNB extends beyond the digital realm. Through initiatives like Binance Pay, BNB is increasingly being used as a medium of exchange for real-world goods and services. Users can shop online, book travel, and pay for services at a growing number of merchants who accept BNB. This push into “PayFi” (Payment Finance) is a strategic move to bridge the gap between the traditional economy and the digital asset world, creating yet another layer of utility and demand for the token.

This multi-pronged utility is what sets BNB apart from many other cryptocurrencies. Its value is not based solely on speculation but is deeply embedded in a thriving and diverse economic ecosystem. This fundamental demand provides a strong floor for its valuation and is a key reason for its long-term resilience and growth potential.

The Tokenomics of Scarcity: Understanding the BNB Burn

A crucial and often underestimated factor in BNB’s long-term value proposition is its deflationary tokenomics. Unlike fiat currencies, which can be printed at will by central banks, and even unlike some cryptocurrencies with a fixed or inflationary supply, BNB is designed to become scarcer over time. This is achieved through a mechanism known as the quarterly

auto-burn. Understanding this process is key to appreciating the long-term investment thesis for BNB.

What is the BNB Auto-Burn?

In its original design, Binance committed to using 20% of its quarterly profits to buy back BNB tokens on the open market and permanently destroy them. This process was designed to continue until 100 million BNB, or 50% of the total initial supply of 200 million, had been removed from circulation. However, in late 2021, this mechanism was replaced with the BNB Auto-Burn, a system designed to be more objective, auditable, and independent of the Binance exchange’s revenues.

The auto-burn formula is based on two factors:

- The price of BNB: A higher price means fewer tokens need to be burned to reach the target value.

- The number of blocks produced on the BNB Chain during the quarter: This serves as a proxy for the level of activity and economic value generated on the network.

The formula is designed to be dynamic, automatically adjusting the number of tokens to be burned each quarter to maintain a consistent reduction in supply. The ultimate goal remains the same: to reduce the total circulating supply of BNB to 100 million tokens.

The Economics of Deflation

The principle at play here is simple supply and demand. By systematically and permanently removing tokens from circulation, the BNB burn mechanism reduces the total supply. If demand for BNB remains constant or, more likely, increases due to the ecosystem’s growth, this reduction in supply will exert a natural upward pressure on the price. Each token becomes a larger slice of a smaller pie, making it inherently more valuable.

This deflationary pressure is a powerful long-term tailwind for the price of BNB. It provides a level of programmatic scarcity that is rare even in the world of cryptocurrencies. For long-term investors, the quarterly burn is a highly anticipated event, a transparent and verifiable commitment to increasing the value of their holdings. It transforms BNB from a simple utility token into a deflationary asset, adding another compelling layer to its investment case.

More Than a Price Tag: What BNB’s ATH Means for the Broader Crypto Market

BNB’s surge to a new all-time high is not an isolated event. As one of the largest and most influential assets in the digital currency space, its performance has significant implications for the entire market. It acts as a barometer of investor sentiment, a driver of institutional interest, and a catalyst for competition and innovation. Here’s a deeper look at the ripple effects of BNB’s historic achievement.

A Rising Tide for Altcoins and DeFi

In the crypto market, sentiment is contagious. A strong performance by a major-cap altcoin like BNB often signals a broader “altcoin season,” a period where alternative cryptocurrencies outperform Bitcoin. BNB’s rally has injected a fresh wave of confidence and capital into the market, encouraging investors to look beyond Bitcoin and explore other promising projects. This renewed optimism can lead to increased trading volumes and price appreciation across a wide range of altcoins, particularly those within the DeFi sector.

Furthermore, BNB Chain is one of the largest and most active platforms for Decentralized Finance (DeFi). Its growth is directly tied to the health of the DeFi ecosystem. As more users and capital flow into BNB Chain to interact with its various DeFi protocols, it creates a positive feedback loop. Liquidity deepens, new projects are incentivized to build on the platform, and the entire DeFi space becomes more robust and vibrant. BNB’s success, therefore, serves as a powerful engine for growth and innovation within the decentralized finance landscape.

A Beacon for Institutional Investment

Institutional investors, such as hedge funds, asset managers, and corporations, are notoriously risk-averse. They require clear signals of stability, growth, and regulatory clarity before deploying significant capital into a new asset class. BNB’s recent performance provides all three. Its ability to surpass the market capitalization of a legacy tech giant like Intel is a powerful statement that these institutions cannot ignore. It demonstrates that digital assets are no longer a niche or fringe investment but are becoming a major force in the global financial system.

The improving regulatory climate, a key driver of the rally, further de-risks the asset class for these large players. A clear and supportive regulatory framework is a prerequisite for widespread institutional adoption. As regulatory uncertainty fades, the floodgates for institutional capital can begin to open. BNB’s rally, in this context, acts as a beacon, attracting the attention of institutional investors and signaling that the time to enter the crypto market may have arrived.

Intensifying the Smart Contract Platform Wars

At its core, BNB Chain is a smart contract platform, a direct competitor to Ethereum, Solana, Cardano, and others. The battle for dominance in this space is fierce, as the winning platforms will form the foundational layer for the next generation of the internet, often called Web3. BNB’s success intensifies this competition, putting pressure on other platforms to innovate and attract users and developers.

BNB Chain’s key advantages have always been its high transaction speeds and low fees, which have made it an attractive alternative to the often-congested and expensive Ethereum network. Its recent growth and the surge in the price of its native token further strengthen its position in this race. This healthy competition is ultimately a good thing for the industry, as it pushes all platforms to improve their technology, lower their fees, and provide better tools for developers. The success of BNB raises the stakes for everyone and accelerates the pace of innovation across the entire Web3 landscape.

| Feature | BNB Chain | Ethereum | Solana |

|---|---|---|---|

| Transaction Speed (TPS) | ~2,000 | ~15-30 (L1) | ~65,000 |

| Average Transaction Fee | ~$0.10 | ~$5-50 (L1) | ~$0.00025 |

| Decentralization | More centralized (21 validators) | Highly decentralized | Moderately decentralized |

| Ecosystem Size | Vast and mature | Largest and most established | Rapidly growing |

The Road Ahead: Price Targets, Challenges, and the Future of BNB

With a new all-time high in the rearview mirror, the natural question on every investor’s mind is: what’s next? While the momentum is undeniably bullish, the road ahead for BNB is not without its potential challenges. A comprehensive analysis requires a balanced look at both the ambitious future targets and the risks that could impede its progress.

The Path to $2,000 and Beyond: Analyst Outlook

Following the decisive break above the $1,000 level, many analysts and traders have set their sights on the next major psychological milestone: $2,000. This target is not just wishful thinking; it is based on technical analysis patterns, market sentiment, and the continued growth of the BNB ecosystem. The recent price action has established a strong support level around the previous all-time highs, creating a solid foundation for the next leg up. As analyst Gael Gallot noted, BNB holding above the $970 support level is a sign of healthy consolidation, suggesting that the market is building energy for a continued move higher.

The long-term outlook is even more optimistic, with some analysts predicting that BNB could eventually challenge Ethereum for the number two spot in the crypto market rankings. This would require a significant increase in market capitalization, but given BNB’s rapid growth and the expanding utility of its ecosystem, it is a possibility that is no longer out of the realm of imagination. The key will be continued innovation, user adoption, and a favorable regulatory environment.

Navigating the Challenges: Potential Roadblocks for BNB

Despite the bullish sentiment, it would be naive to ignore the potential risks and challenges that lie ahead. The crypto market is notoriously volatile, and a number of factors could potentially derail BNB’s upward trajectory:

- Regulatory Whiplash: While the current regulatory environment is favorable, this could change. A new administration with a different stance on crypto, or a major global regulatory crackdown, could quickly reverse the current optimism. The fate of the CZ pardon speculation is also a major wildcard. If a pardon does not materialize, it could lead to a sharp, short-term correction in the price of BNB.

- Market Volatility and Corrections: The crypto market is prone to sharp and sudden corrections. After a rapid price increase, a period of consolidation or a pullback is not only possible but healthy. A broader market downturn, triggered by macroeconomic factors or a major negative event, would inevitably impact BNB as well.

- Intensifying Competition: The smart contract platform space is becoming increasingly crowded. While BNB Chain currently enjoys a strong position, it faces intense competition from Ethereum and its growing ecosystem of Layer 2 scaling solutions, as well as from other high-performance blockchains like Solana, which are also innovating at a rapid pace. BNB Chain must continue to evolve and improve to maintain its competitive edge.

- Centralization Concerns: One of the most persistent criticisms leveled against BNB Chain is its perceived level of centralization compared to more decentralized platforms like Ethereum. While this centralization allows for higher speeds and lower fees, it is a trade-off that some purists in the crypto community are uncomfortable with. A major security breach or a controversial governance decision could reignite these concerns and negatively impact investor confidence.

Conclusion: A New Era for BNB and the Crypto Market

BNB’s surge to a new all-time high is a landmark event that signifies more than just a remarkable price rally. It is a testament to the power of a robust and ever-expanding ecosystem, a reflection of a maturing industry that is gaining mainstream acceptance, and a powerful symbol of the shifting dynamics in the global financial landscape. The confluence of fundamental strength, regulatory optimism, and compelling market narratives has created a perfect storm, propelling BNB into a new era of growth and influence.

The implications for the broader crypto market are profound. BNB’s success is a rising tide that lifts all boats, injecting confidence into the altcoin market, attracting the attention of institutional investors, and intensifying the competition that drives innovation in the Web3 space. It is a clear signal that the digital asset industry is not just surviving, but thriving, and is beginning to seriously challenge the dominance of legacy financial systems.

However, the road ahead is not without its challenges. The inherent volatility of the crypto market, the ever-present specter of regulatory change, and the fierce competition from other platforms are all significant hurdles that must be navigated. But for now, the momentum is undeniably with BNB. Its journey from a simple exchange token to a multi-billion dollar ecosystem is one of the most compelling stories in the crypto space, and its recent all-time high suggests that the next chapter of that story may be even more exciting. As the digital asset market continues to evolve, the world will be watching to see if BNB can build on its current success and solidify its position as a true pillar of the new financial world.

A Journey Through Time: The Evolution of BNB

To fully appreciate the significance of BNB’s current standing, it’s essential to look back at its origins and trace its remarkable journey. BNB was not born a giant; it has evolved through strategic innovation, relentless building, and a keen understanding of the market’s needs. Its history is a microcosm of the crypto industry’s own rapid development.

The ICO and Early Days (2017)

BNB was launched in July 2017 through an Initial Coin Offering (ICO), a popular fundraising method during the crypto boom of that year. The ICO was conducted just before the official launch of the Binance exchange. The initial price of BNB was approximately $0.15 per token. The primary purpose of the token was simple and brilliant: to offer a discount on trading fees for users of the new exchange. This created an immediate and practical use case, driving early adoption and embedding BNB into the core user experience of what would quickly become the world’s leading crypto trading platform.

From ERC-20 Token to Native Blockchain (2019)

Initially, BNB was an ERC-20 token, meaning it was built on the Ethereum blockchain. However, the vision for BNB was always much grander than just being a discount token. In April 2019, Binance launched its own native blockchain, the Binance Chain. This was a pivotal moment in BNB’s history. All existing ERC-20 BNB tokens were migrated to the new native chain in a 1:1 swap. This move transformed BNB from a dependent token into the native asset of its own sovereign blockchain, giving it a new level of utility and independence. The Binance Chain was optimized for fast and decentralized trading, laying the groundwork for the Binance DEX (Decentralized Exchange).

The Birth of the BNB Chain and the DeFi Explosion (2020)

The next major evolutionary leap came in September 2020 with the launch of the Binance Smart Chain (BSC), which now operates in parallel with the original Binance Chain. This was a game-changer. While the original chain was optimized for speed, BSC introduced smart contract functionality that was fully compatible with the Ethereum Virtual Machine (EVM). This meant that developers could easily port their existing Ethereum-based applications over to BSC, or build new ones from scratch using familiar tools. This move was perfectly timed to capitalize on the burgeoning DeFi summer of 2020. With Ethereum’s network plagued by high fees and slow transaction times, BSC offered a fast, cheap, and scalable alternative. This led to an explosion of activity on the network, with a massive influx of users, developers, and capital. BNB’s role expanded once again, becoming the gas token for this new, vibrant DeFi ecosystem.

Consolidation and the Road to Mainstream Adoption (2021-Present)

In the years since, the two chains were merged under the single banner of the BNB Chain, a multi-chain ecosystem that combines the best of both worlds. The focus has been on further improving scalability, decentralization, and developer support. The introduction of the auto-burn mechanism in late 2021 solidified BNB’s deflationary tokenomics, adding another layer of appeal for long-term investors. The ecosystem has continued to expand into new areas like NFTs, GameFi (Game Finance), and the metaverse, with BNB at the center of it all. This relentless focus on building and expanding utility has been the driving force behind BNB’s journey from a simple ICO token to a global financial powerhouse.

Reading the Charts: A Technical Perspective on BNB’s Rally

While the fundamental drivers and market narratives provide the ‘why’ behind BNB’s rally, technical analysis offers insights into the ‘how’ and ‘what’s next’. By examining the price chart, we can identify key patterns, levels, and indicators that can help us understand the market’s psychology and potential future movements.

The Breakout and Confirmation

The surge to over $1,000 was not a random event; it was a classic technical breakout. For months, BNB had been consolidating in a range, building up energy for its next major move. The price faced significant resistance at its previous all-time high. The decisive move above this level, on high volume, was a strong bullish signal. This breakout was followed by a period of consolidation, where the price re-tested the previous resistance level, which now acted as support. This is a textbook technical pattern known as ‘resistance-turned-support’, and it is a very strong confirmation that the breakout is legitimate and that the market has accepted the new, higher valuation.

Key Support and Resistance Levels

In the near term, the key support level to watch is the area around the previous all-time high, roughly in the $970-$1,000 range. As long as the price remains above this level, the bullish trend remains intact. A break below this level could signal a deeper correction. On the upside, with the price in ‘blue sky territory’ (i.e., with no previous price history to act as resistance), the next major resistance levels are psychological. The $1,500 and $2,000 levels are the obvious next targets that traders will be watching. These round numbers often act as magnets for price, as well as areas where traders may look to take profits.

The Role of Moving Averages

Moving averages are another key tool for identifying the trend. The 50-day and 200-day moving averages are widely followed by traders. A ‘golden cross’, where the 50-day moving average crosses above the 200-day moving average, is a strong bullish signal that often precedes a major rally. BNB experienced a golden cross earlier in the year, which set the stage for its recent surge. As long as the price remains above these key moving averages, the long-term trend is considered bullish.

Volume and Momentum Indicators

The volume profile during the breakout was also very telling. The surge above the previous all-time high was accompanied by a significant spike in trading volume, indicating strong conviction from buyers. Momentum indicators like the Relative Strength Index (RSI) can also provide valuable insights. While a high RSI can indicate that an asset is ‘overbought’ in the short term, it can also be a sign of strong momentum. During a powerful uptrend, it is not uncommon for the RSI to remain in overbought territory for an extended period. A divergence between the price and the RSI (e.g., the price making a new high while the RSI makes a lower high) can be an early warning sign that the momentum is starting to wane.

While technical analysis is not a crystal ball, it provides a valuable framework for understanding market dynamics and managing risk. The technical picture for BNB is currently very strong, with a confirmed breakout, a clear uptrend, and strong momentum. However, traders should always be mindful of the potential for corrections and use appropriate risk management strategies.

Expanded Conclusion: A New Era for BNB and the Crypto Market

BNB’s surge to a new all-time high is a landmark event that signifies more than just a remarkable price rally. It is a testament to the power of a robust and ever-expanding ecosystem, a reflection of a maturing industry that is gaining mainstream acceptance, and a powerful symbol of the shifting dynamics in the global financial landscape. The confluence of fundamental strength, regulatory optimism, and compelling market narratives has created a perfect storm, propelling BNB into a new era of growth and influence.

The implications for the broader crypto market are profound. BNB’s success is a rising tide that lifts all boats, injecting confidence into the altcoin market, attracting the attention of institutional investors, and intensifying the competition that drives innovation in the Web3 space. It is a clear signal that the digital asset industry is not just surviving, but thriving, and is beginning to seriously challenge the dominance of legacy financial systems.

However, the road ahead is not without its challenges. The inherent volatility of the crypto market, the ever-present specter of regulatory change, and the fierce competition from other platforms are all significant hurdles that must be navigated. But for now, the momentum is undeniably with BNB. Its journey from a simple exchange token to a multi-billion dollar ecosystem is one of the most compelling stories in the crypto space, and its recent all-time high suggests that the next chapter of that story may be even more exciting. As the digital asset market continues to evolve, the world will be watching to see if BNB can build on its current success and solidify its position as a true pillar of the new financial world.

Ultimately, the story of BNB is a story of relentless execution. While other projects have focused on lofty promises and theoretical decentralization, Binance and the BNB Chain community have focused on building products that people want to use. This pragmatic, user-centric approach has been the key to its success and is the reason why it has been able to capture such a significant share of the market. The all-time high is not the end of the journey, but rather a validation of this strategy and a sign of even greater things to come.